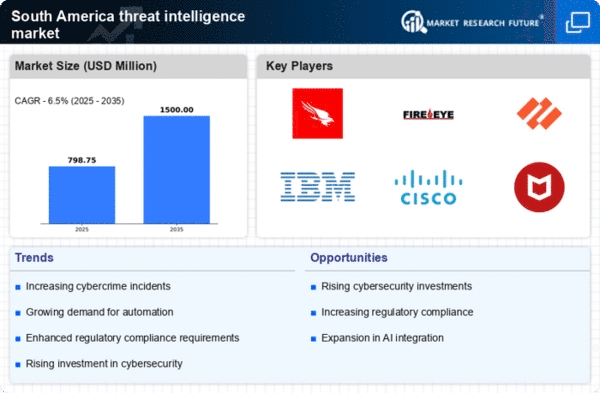

Rising Cyber Threats

The escalation of cyber threats in South America is a primary driver for the threat intelligence market. With incidents of ransomware, phishing, and data breaches on the rise, organizations are compelled to invest in advanced threat intelligence solutions. Reports indicate that cybercrime costs in the region could reach $90 billion annually by 2025, highlighting the urgent need for effective threat detection and response mechanisms. As businesses increasingly recognize the potential financial and reputational damage from cyber incidents, the demand for threat intelligence services is expected to grow significantly. This trend is likely to propel the threat intelligence market forward, as companies seek to mitigate risks and enhance their cybersecurity posture.

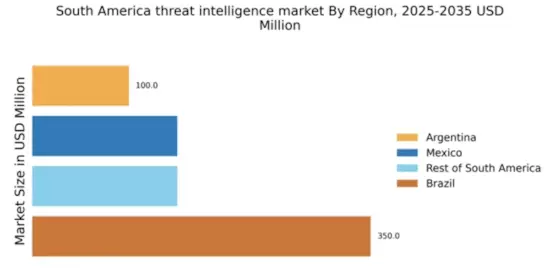

Regulatory Compliance Requirements

In South America, the implementation of stringent data protection regulations is driving the demand for threat intelligence solutions. Laws such as the General Data Protection Law (LGPD) in Brazil impose heavy penalties for data breaches, compelling organizations to adopt robust cybersecurity measures. Compliance with these regulations necessitates the integration of threat intelligence capabilities to identify and respond to potential threats proactively. The threat intelligence market is likely to benefit from this regulatory landscape, as businesses invest in technologies that ensure compliance while safeguarding sensitive information. As organizations strive to avoid costly fines and maintain customer trust, the market for threat intelligence solutions is expected to expand.

Growing Awareness of Cybersecurity Risks

There is a notable increase in awareness regarding cybersecurity risks among businesses in South America. This heightened consciousness is largely driven by high-profile cyber incidents that have affected various sectors, including finance and healthcare. As organizations recognize the potential impact of cyber threats on their operations, they are more inclined to invest in threat intelligence solutions. The threat intelligence market is likely to see a surge in demand as companies seek to enhance their security frameworks and protect their assets. Furthermore, educational initiatives and industry collaborations are fostering a culture of cybersecurity awareness, further propelling the market's growth.

Increased Investment in Digital Transformation

The ongoing digital transformation across various sectors in South America is driving the demand for threat intelligence solutions. As organizations migrate to cloud-based services and adopt digital tools, they become more vulnerable to cyber threats. This shift necessitates the implementation of robust threat intelligence strategies to safeguard digital assets. The threat intelligence market is poised for growth as companies recognize the importance of integrating cybersecurity measures into their digital transformation initiatives. With investments in technology expected to reach $50 billion by 2026, the market for threat intelligence solutions is likely to expand significantly.

Technological Advancements in Threat Detection

Technological advancements are playing a crucial role in shaping the threat intelligence market in South America. Innovations in machine learning, artificial intelligence, and big data analytics are enhancing the capabilities of threat detection and response systems. These technologies enable organizations to analyze vast amounts of data in real-time, identifying potential threats more effectively. As businesses increasingly adopt these advanced technologies, the demand for sophisticated threat intelligence solutions is expected to rise. The market is likely to witness significant growth as organizations leverage these innovations to stay ahead of evolving cyber threats.