Growing Aging Population

The growing aging population in South America is a critical driver for the surgical microscopes market. As the demographic shifts towards an older population, the prevalence of age-related health issues, such as cataracts and orthopedic conditions, increases. This demographic trend necessitates more surgical interventions, thereby driving the demand for surgical microscopes. For instance, it is estimated that by 2030, the elderly population in South America will account for over 15% of the total population, leading to a higher demand for surgical procedures. Consequently, healthcare providers are likely to invest in advanced surgical microscopes to cater to this demographic's needs. This shift not only enhances surgical outcomes but also positions the surgical microscopes market for sustained growth as it adapts to the evolving healthcare landscape.

Surge in Surgical Procedures

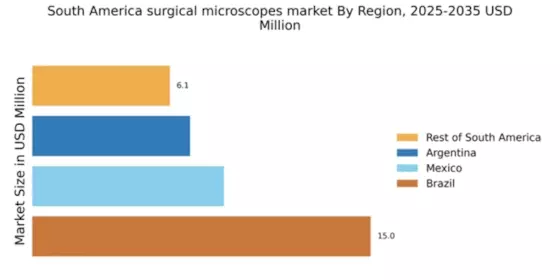

The surge in surgical procedures across South America significantly impacts the surgical microscopes market. With an increasing population and advancements in medical technology, the number of surgeries performed is on the rise. For example, Brazil and Argentina have reported a steady increase in elective surgeries, which often require the precision offered by surgical microscopes. The demand for these procedures is projected to grow by approximately 5% annually, leading to a corresponding increase in the need for advanced surgical microscopes. This trend is further supported by the growing awareness of the benefits of minimally invasive surgeries, which often utilize these microscopes. As surgical centers expand their capabilities to accommodate more procedures, the surgical microscopes market is likely to experience robust growth in response to this demand.

Increasing Healthcare Expenditure

The rising healthcare expenditure in South America is a pivotal driver for the surgical microscopes market. Governments and private sectors are investing more in healthcare infrastructure, which includes advanced surgical equipment. For instance, Brazil's healthcare spending has seen a notable increase, reaching approximately $200 billion in 2025. This financial commitment facilitates the acquisition of sophisticated surgical microscopes, enhancing surgical precision and outcomes. As hospitals and surgical centers upgrade their facilities, the demand for high-quality surgical microscopes is expected to grow. This trend is likely to be mirrored across other South American nations, where healthcare budgets are expanding to meet the needs of a growing population. Consequently, the surgical microscopes market is poised for growth as healthcare providers seek to improve surgical capabilities and patient care.

Rising Awareness of Surgical Precision

Rising awareness of the importance of surgical precision is a significant driver for the surgical microscopes market in South America. As patients become more informed about their treatment options, there is an increasing demand for procedures that ensure better outcomes and reduced recovery times. This awareness is prompting healthcare providers to invest in high-quality surgical microscopes that offer enhanced visualization and accuracy during surgeries. In countries like Peru and Uruguay, the emphasis on patient safety and surgical success rates is leading to a greater adoption of advanced surgical microscopes. The market is expected to grow as more healthcare facilities recognize the value of precision in surgical procedures. This trend not only benefits patients but also positions the surgical microscopes market for continued expansion as it aligns with evolving patient expectations.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the surgical microscopes market in South America. Innovations such as augmented reality and artificial intelligence are being incorporated into surgical microscopes, enhancing their functionality and precision. This technological evolution is particularly evident in countries like Chile and Colombia, where hospitals are increasingly adopting these advanced systems to improve surgical outcomes. The market for surgical microscopes is projected to grow by approximately 7% annually as healthcare facilities seek to leverage these technologies. This trend indicates a shift towards more sophisticated surgical techniques, which require high-quality microscopes. As healthcare providers continue to embrace technological advancements, the surgical microscopes market is likely to expand, driven by the demand for enhanced surgical capabilities.