Increased Focus on Road Safety

The heightened focus on road safety in South America is driving the smart highways market. Governments and organizations are increasingly recognizing the need to reduce traffic accidents and fatalities, which have been alarmingly high in several countries. For example, the Inter-American Development Bank reports that road traffic injuries cost South American economies approximately $30 billion annually. In response, investments in smart highway technologies, such as automated warning systems and real-time monitoring, are becoming more prevalent. This emphasis on safety is likely to propel the market forward, with projections suggesting a growth rate of 12% as stakeholders prioritize the implementation of solutions that enhance road safety and reduce accident rates.

Rising Urbanization and Traffic Congestion

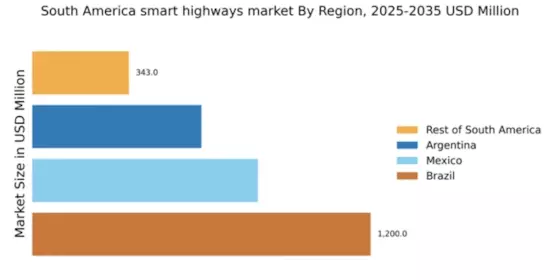

The rapid urbanization in South America is contributing to increased traffic congestion, thereby propelling the smart highways market. As urban populations swell, cities like Buenos Aires and Sao Paulo face severe traffic challenges, leading to longer commute times and heightened pollution levels. In response, local governments are exploring smart highway solutions that utilize intelligent transportation systems to optimize traffic flow. The market for smart highways is projected to grow by approximately 20% in urban areas as municipalities invest in technologies that enhance mobility and reduce congestion. This trend indicates a pressing need for innovative solutions to manage the growing number of vehicles on the roads, making smart highways a critical component of urban planning.

Technological Advancements in Connectivity

Technological advancements in connectivity are significantly influencing the smart highways market in South America. The proliferation of 5G networks is enabling real-time communication between vehicles and infrastructure, enhancing safety and efficiency on the roads. Countries like Chile are at the forefront of deploying 5G technology, which is expected to cover 80% of urban areas by 2026. This connectivity allows for the implementation of smart traffic signals, vehicle-to-infrastructure communication, and automated toll systems, all of which contribute to a more efficient transportation network. The smart highways market is anticipated to benefit from these advancements, with an estimated growth rate of 18% as more regions adopt these technologies to improve road safety and reduce travel times.

Environmental Regulations and Sustainability Goals

Environmental regulations and sustainability goals are emerging as key drivers of the smart highways market in South America. Governments are increasingly implementing policies aimed at reducing carbon emissions and promoting sustainable transportation solutions. For instance, Colombia's commitment to achieving a 30% reduction in greenhouse gas emissions by 2030 is prompting investments in smart highway technologies that facilitate eco-friendly transportation. The integration of electric vehicle charging stations and smart traffic management systems aligns with these sustainability objectives. As a result, the smart highways market is expected to grow by 14% as stakeholders seek to comply with environmental regulations while enhancing the efficiency of transportation networks.

Government Initiatives for Infrastructure Modernization

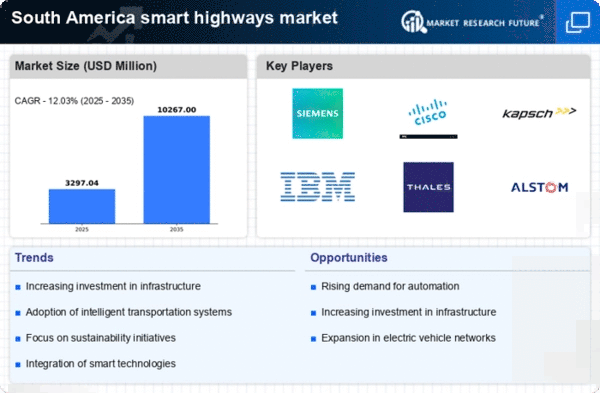

In South America, government initiatives aimed at modernizing infrastructure are driving the smart highways market. Various countries are investing heavily in upgrading their transportation networks to enhance efficiency and safety. For instance, Brazil's National Transport Plan allocates substantial funds for smart infrastructure projects, which are expected to reach $10 billion by 2027. These initiatives not only improve road conditions but also integrate advanced technologies such as traffic management systems and real-time data analytics. As a result, the smart highways market is likely to experience significant growth, with projections indicating a compound annual growth rate (CAGR) of 15% over the next five years. This focus on modernization reflects a broader commitment to improving transportation systems across the region.