Government Policies and Incentives

Government initiatives play a pivotal role in shaping the smart commute market in South America. Various countries are implementing policies aimed at reducing traffic congestion and promoting sustainable transport solutions. For instance, Brazil has introduced tax incentives for electric vehicle (EV) manufacturers and users, which encourages the adoption of EVs in urban areas. Additionally, public funding for smart infrastructure projects is on the rise, with an estimated investment of $1 billion in smart transport systems across major cities. These policies not only stimulate market growth but also align with broader environmental goals, making the smart commute market an attractive sector for investment and innovation.

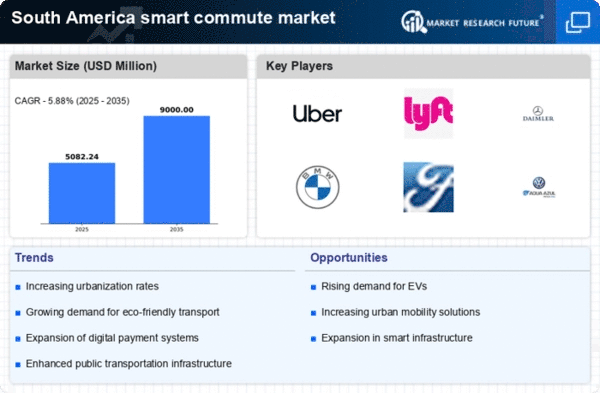

Urbanization and Population Growth

The rapid urbanization in South America is a crucial driver for the smart commute market. As urban populations increase, the demand for efficient transportation solutions intensifies. In cities like Sao Paulo and Buenos Aires, where population density is high, traditional commuting methods are becoming less viable. The smart commute market is responding to this challenge by offering innovative solutions such as ride-sharing and smart public transport systems. According to recent data, urban areas in South America are expected to grow by approximately 2.5% annually, further necessitating the development of smart commuting options. This growth presents opportunities for technology providers and transport operators to collaborate and enhance the commuting experience, ultimately leading to reduced congestion and improved air quality.

Investment in Infrastructure Development

Investment in transportation infrastructure is a critical driver for the smart commute market in South America. Governments and private entities are increasingly recognizing the need for modernized transport systems to accommodate growing urban populations. Recent reports suggest that infrastructure spending in the region is projected to reach $200 billion over the next five years, focusing on smart technologies and sustainable transport solutions. This investment is expected to enhance connectivity and reduce travel times, making smart commuting options more appealing. Additionally, improved infrastructure can facilitate the integration of various transport modes, such as buses, trains, and cycling paths, thereby promoting a seamless commuting experience. As infrastructure development progresses, the smart commute market is likely to flourish.

Environmental Awareness and Climate Change

Growing environmental consciousness among consumers is driving the smart commute market in South America. As awareness of climate change impacts increases, individuals are seeking greener commuting options. This shift is evident in the rising demand for public transport and shared mobility solutions, which are perceived as more sustainable alternatives to private vehicle use. Recent surveys indicate that approximately 60% of urban commuters in South America are willing to switch to eco-friendly transport options. Consequently, transport providers are adapting their services to meet this demand, leading to the development of electric buses and bike-sharing programs. This trend not only supports environmental goals but also enhances the attractiveness of the smart commute market.

Technological Advancements in Mobility Solutions

Technological innovation is a significant driver of the smart commute market in South America. The proliferation of mobile applications and IoT devices has transformed how commuters interact with transportation services. For example, ride-hailing apps have gained immense popularity, with a reported 30% increase in usage over the past year. Furthermore, advancements in data analytics enable transport providers to optimize routes and improve service efficiency. The integration of AI and machine learning into traffic management systems is also enhancing the overall commuting experience. As technology continues to evolve, the smart commute market is likely to see further enhancements in service delivery and user engagement, making commuting more convenient and efficient.