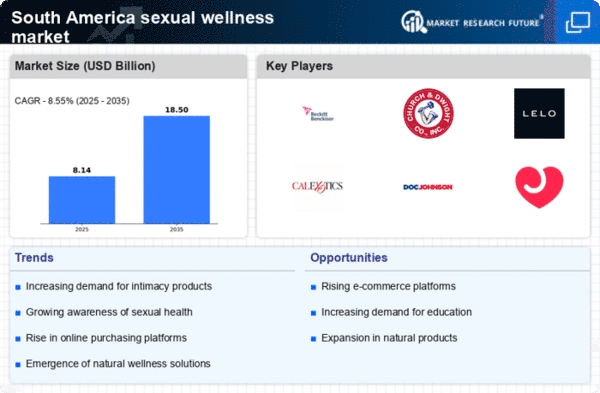

Expansion of Retail Channels

The expansion of retail channels for sexual wellness products in South America is a significant driver for the industry. Traditional brick-and-mortar stores, as well as online platforms, are increasingly offering a diverse range of products. This accessibility allows consumers to explore and purchase items in a more comfortable environment. The sexual wellness market is benefiting from this trend, as it caters to a wider audience through various retail formats. Recent data indicates that sales through retail channels have increased by approximately 12% in the last year, highlighting the importance of availability in driving consumer purchases. As more retailers recognize the demand for sexual wellness products, the market is likely to see continued growth.

Innovations in Product Development

Innovations in product development are playing a crucial role in shaping the sexual wellness market in South America. Companies are increasingly focusing on creating new and improved products that cater to diverse consumer needs. This includes the introduction of organic and eco-friendly options, which appeal to health-conscious consumers. The market has witnessed a surge in innovative products, with some companies reporting a 25% increase in sales for newly launched items. As consumers seek unique and effective solutions for their sexual wellness, the industry is likely to continue evolving. This emphasis on innovation not only enhances consumer choice but also drives competition among brands, further stimulating growth in the sector.

Rising Awareness of Sexual Health Issues

There is a growing awareness of sexual health issues in South America, which is driving demand for products in the sexual wellness market. Educational campaigns and public health initiatives have highlighted the importance of sexual health, leading to increased consumer interest in products that promote well-being. This heightened awareness is reflected in the rising sales of sexual health-related products, which have seen a growth rate of around 10% annually. As consumers become more informed about sexual health, they are more likely to seek out products that address their needs, thereby contributing to the overall growth of the industry. This trend suggests a positive trajectory for the sexual wellness market as awareness continues to expand.

Growing Acceptance of Sexual Wellness Products

The increasing acceptance of sexual wellness products in South America is a notable driver for the industry. Cultural shifts towards more open discussions about sexual health have led to a rise in consumer interest. This acceptance is reflected in the growing sales of sexual wellness products, which have seen an increase of approximately 15% annually in recent years. As societal norms evolve, consumers are more willing to explore and purchase products that enhance their sexual experiences. This trend is particularly evident among younger demographics, who prioritize sexual health and wellness. The sexual wellness market is thus benefiting from a more informed and open-minded consumer base, which is likely to continue driving growth in the sector.

Influence of Social Media and Digital Marketing

Social media platforms have become powerful tools for promoting sexual wellness products in South America. The sexual wellness market is leveraging these platforms to reach a broader audience, particularly younger consumers who are active online. Influencers and brands are utilizing targeted advertising and engaging content to educate consumers about the benefits of various products. This digital marketing approach has resulted in a significant increase in online sales, with e-commerce in the sector growing by over 20% in the past year. The ability to connect with consumers directly through social media allows brands to build trust and foster community, which is essential for the continued expansion of the sexual wellness market.