Financial Inclusion Initiatives

Financial inclusion initiatives are increasingly shaping the remittance market in South America. Governments and organizations are working to provide unbanked populations with access to financial services, which can facilitate remittance transactions. In 2025, it is estimated that initiatives aimed at increasing financial literacy and access to banking services will lead to a 15% rise in the number of individuals using formal remittance channels. This shift not only enhances the security of transactions but also promotes economic stability within communities. The remittance market stands to gain from these efforts, as more individuals are empowered to participate in the financial system, ultimately driving growth in remittance volumes and contributing to local economies.

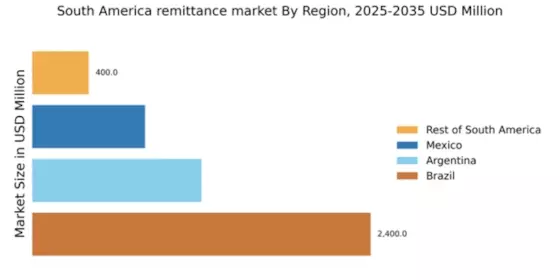

Economic Growth in South America

The remittance market in South America is significantly influenced by the region's economic growth. As economies expand, disposable incomes tend to rise, leading to increased financial stability for families. This growth often results in higher remittance flows, as individuals working abroad are more likely to send money home. In 2025, remittances to South America are projected to reach approximately $100 billion, reflecting a growth rate of around 8% compared to previous years. This influx of funds plays a crucial role in supporting local economies, enhancing consumer spending, and improving living standards. The remittance market thus benefits from the positive correlation between economic performance and remittance volumes, indicating a robust future for financial transfers within the region.

Migration Patterns and Labor Demand

Migration patterns play a pivotal role in shaping the remittance market in South America. As individuals seek better employment opportunities abroad, the demand for labor in various sectors increases. Countries such as the United States and Spain remain key destinations for South American migrants, who often send remittances back home to support their families. In 2025, it is projected that remittances from South American migrants will account for approximately 3% of the region's GDP, underscoring the economic importance of these financial flows. The remittance market thus thrives on the continuous movement of people, as each migrant represents a potential source of financial support for their home country, contributing to local economies and fostering development.

Regulatory Frameworks and Compliance

The regulatory frameworks governing the remittance market in South America are crucial for ensuring secure and efficient transactions. Governments are increasingly focusing on compliance measures to combat money laundering and fraud, which can impact the flow of remittances. In 2025, it is anticipated that stricter regulations will be implemented, requiring remittance service providers to enhance their compliance protocols. While this may pose challenges for some operators, it also creates opportunities for those who can adapt to the evolving landscape. A transparent regulatory environment can foster trust among consumers, encouraging more individuals to utilize formal channels for remittances. Thus, the remittance market is likely to benefit from improved regulatory practices that enhance security and reliability.

Technological Advancements in Payment Systems

Technological advancements are reshaping the remittance market in South America, facilitating faster and more secure transactions. Innovations such as mobile wallets, blockchain technology, and online money transfer services are becoming increasingly prevalent. These technologies reduce transaction costs and enhance user experience, making it easier for individuals to send money across borders. In 2025, it is estimated that over 50% of remittance transactions in South America will be conducted through digital platforms, reflecting a shift towards more efficient payment systems. This transformation not only streamlines the remittance process but also attracts a younger demographic, who are more inclined to utilize digital solutions. Consequently, the remittance market is likely to experience significant growth driven by these technological improvements.