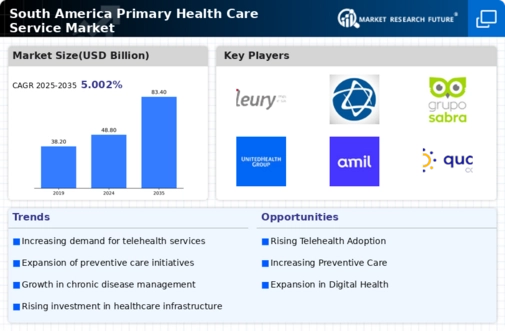

Growing Demand for Accessible Care

The primary health-care-service market in South America experiences a notable increase in demand for accessible care. This trend is driven by a rising population and urbanization, which places pressure on existing health systems. Approximately 60% of the population resides in urban areas, leading to a higher concentration of health service needs. Furthermore, the demand for services is amplified by an aging population, with projections indicating that by 2030, individuals aged 60 and above will constitute 20% of the total population. This demographic shift necessitates enhanced access to primary health care, prompting investments in facilities and workforce training. As a result, stakeholders in the primary health-care-service market are likely to prioritize strategies that improve accessibility and affordability, ensuring that care reaches underserved communities.

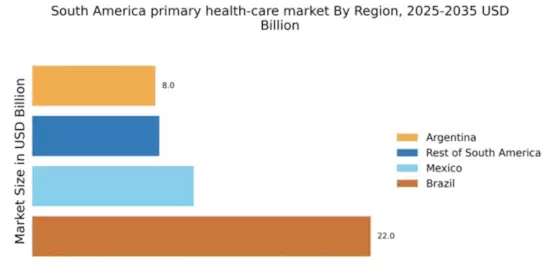

Government Initiatives for Health Reform

In South America, government initiatives aimed at health reform are significantly influencing the primary health-care-service market. Various countries are implementing policies to expand health coverage and improve service quality. For instance, Brazil's Unified Health System (SUS) aims to provide universal access to health services, which has led to a 15% increase in primary care consultations over the past three years. Such reforms are often accompanied by increased funding, with some nations allocating up to 10% of their GDP to health care. These initiatives not only enhance the availability of services but also promote preventive care, thereby reducing the long-term burden on health systems. Consequently, the primary health-care-service market is likely to benefit from these reforms, as they create a more robust framework for delivering essential health services.

Rising Health Awareness Among Populations

The primary health-care-service market in South America is witnessing a surge in health awareness among populations. Increased access to information through digital platforms and social media has empowered individuals to prioritize their health. Surveys indicate that over 70% of respondents are now more conscious of preventive health measures, leading to a higher demand for primary care services. This shift in mindset encourages regular health check-ups and screenings, which are essential for early detection and management of health issues. As a result, health care providers are adapting their services to meet this growing demand, focusing on education and outreach programs. This trend not only enhances the overall health of communities but also drives growth within the primary health-care-service market.

Technological Advancements in Health Services

Technological innovations are reshaping the primary health-care-service market in South America. The integration of electronic health records (EHR) and mobile health applications is becoming increasingly prevalent, facilitating better patient management and data sharing. Reports indicate that the adoption of EHR systems has risen by 40% in the last five years, enhancing the efficiency of health care delivery. Additionally, the use of artificial intelligence (AI) in diagnostics and treatment planning is gaining traction, potentially improving patient outcomes. These advancements not only streamline operations but also empower patients to take charge of their health through accessible information. As technology continues to evolve, it is expected that the primary health-care-service market will increasingly leverage these tools to enhance service delivery and patient engagement.

Collaboration Between Public and Private Sectors

Collaboration between public and private sectors is emerging as a key driver in the primary health-care-service market in South America. Partnerships are being formed to enhance service delivery and expand access to care. For example, private entities are increasingly involved in public health initiatives, providing resources and expertise to improve health outcomes. This collaboration has led to innovative solutions, such as mobile clinics and community health programs, which address gaps in service provision. Reports suggest that such partnerships have resulted in a 25% increase in service reach in rural areas. As these collaborations continue to evolve, they are likely to play a crucial role in shaping the future landscape of the primary health-care-service market, fostering a more integrated approach to health care.