Rising Geriatric Population

The demographic shift towards an aging population in South America is a critical factor influencing the pedicle screw-systems market. As the geriatric population increases, so does the incidence of age-related spinal conditions, necessitating surgical interventions. Reports indicate that by 2030, the elderly population in South America is projected to reach 15% of the total population. This demographic trend is likely to drive demand for effective spinal surgery solutions, including pedicle screw systems. The pedicle screw-systems market must prepare for this influx of patients by ensuring the availability of advanced surgical options tailored to the needs of older adults, thereby enhancing treatment efficacy and improving quality of life.

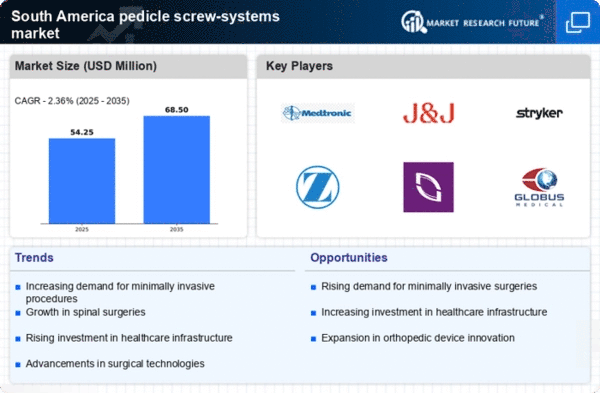

Surge in Healthcare Expenditure

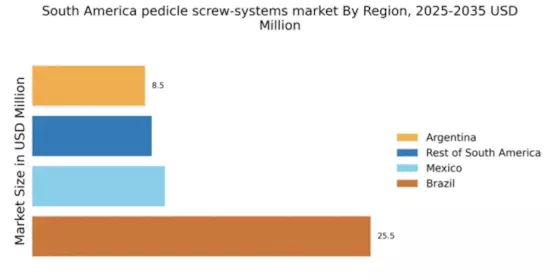

In South America, an increase in healthcare expenditure is significantly impacting the pedicle screw-systems market. Governments and private sectors are investing more in healthcare infrastructure, which includes advanced surgical technologies. For instance, countries like Brazil and Argentina have reported a healthcare spending growth of around 10% annually. This financial commitment facilitates the acquisition of state-of-the-art medical devices, including pedicle screw systems, which are essential for spinal surgeries. As hospitals and surgical centers upgrade their equipment, the demand for high-quality pedicle screw systems is expected to rise. Consequently, the pedicle screw-systems market stands to benefit from this trend, as enhanced funding allows for better patient outcomes and more efficient surgical procedures.

Increasing Incidence of Spinal Disorders

The rising prevalence of spinal disorders in South America is a crucial driver for the pedicle screw-systems market. Conditions such as degenerative disc disease, scoliosis, and spinal stenosis are becoming more common, leading to a higher demand for surgical interventions. According to recent health statistics, spinal disorders affect approximately 30% of the population in some South American countries. This growing patient base necessitates advanced surgical solutions, including pedicle screw systems, to ensure effective treatment outcomes. As healthcare providers seek to improve patient care, the adoption of innovative pedicle screw technologies is likely to increase, thereby propelling market growth. The pedicle screw-systems market must adapt to these changing dynamics to meet the needs of healthcare professionals and patients alike.

Growing Awareness of Advanced Surgical Techniques

There is a notable increase in awareness regarding advanced surgical techniques among both healthcare professionals and patients in South America. This heightened awareness is driving the adoption of innovative solutions, such as pedicle screw systems, which are integral to modern spinal surgeries. Educational initiatives and training programs are being implemented to inform surgeons about the benefits and applications of these systems. As a result, the pedicle screw-systems market is witnessing a shift towards more sophisticated surgical practices. The emphasis on improved surgical outcomes and reduced recovery times is likely to further stimulate demand for these systems, as patients increasingly seek out facilities that offer cutting-edge treatment options.

Expansion of Orthopedic and Neurosurgery Specialties

The expansion of orthopedic and neurosurgery specialties in South America is a significant driver for the pedicle screw-systems market. As more medical professionals specialize in these fields, the demand for specialized surgical tools, including pedicle screw systems, is expected to rise. The establishment of new orthopedic and neurosurgery clinics across the region is indicative of this trend. Furthermore, the increasing number of training programs for surgeons in these specialties is likely to enhance the proficiency in using advanced surgical techniques. This growth in specialization not only improves patient care but also creates a robust market for pedicle screw systems, as healthcare providers seek to equip themselves with the latest technologies to meet patient needs.