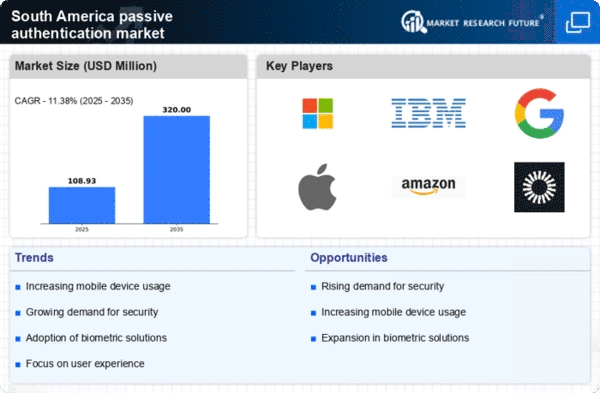

Growing Mobile Device Usage

The proliferation of mobile devices in South America has significantly influenced the passive authentication market. With over 70% of the population using smartphones, the demand for user-friendly authentication methods has surged. Consumers increasingly prefer solutions that do not require active input, such as biometric recognition and behavioral analytics. This shift is reflected in the market, where passive authentication technologies are projected to capture a substantial share of the mobile security segment. The passive authentication market is likely to benefit from this trend, as businesses strive to provide secure yet convenient access to their services on mobile platforms.

Evolving Consumer Expectations

As digital services become more integrated into daily life, consumer expectations regarding security and convenience have evolved. In South America, users are increasingly seeking authentication methods that are both secure and unobtrusive. The passive authentication market is responding to this demand by offering solutions that enhance user experience while maintaining high security standards. Surveys indicate that approximately 65% of consumers prefer authentication methods that do not require active participation. This shift in consumer behavior is likely to drive innovation and investment in passive authentication technologies, as businesses aim to meet these expectations and retain customer loyalty.

Increasing Cybersecurity Threats

The rise in cybersecurity threats across South America has catalyzed the demand for advanced security measures, including those found in the passive authentication market. As organizations face increasing risks from data breaches and identity theft, the need for seamless and secure authentication methods becomes paramount. In 2025, it is estimated that cybercrime could cost businesses in the region upwards of $150 billion annually. This alarming trend drives companies to adopt passive authentication solutions that enhance security without compromising user experience. The passive authentication market is thus positioned to grow as businesses seek to mitigate risks associated with unauthorized access and data loss.

Regulatory Pressures for Data Protection

In South America, regulatory frameworks surrounding data protection are becoming more stringent, compelling organizations to adopt robust security measures. The passive authentication market is experiencing growth as companies seek to comply with regulations that mandate secure handling of personal data. For instance, the implementation of laws similar to the General Data Protection Regulation (GDPR) in Europe is prompting businesses to invest in technologies that ensure compliance. This regulatory pressure is expected to drive the adoption of passive authentication solutions, as they provide a means to enhance security while adhering to legal requirements, thereby reducing the risk of penalties.

Advancements in Technology Infrastructure

The ongoing advancements in technology infrastructure across South America are facilitating the growth of the passive authentication market. Improved internet connectivity and the expansion of cloud services are enabling organizations to implement sophisticated authentication solutions. As businesses increasingly migrate to cloud-based platforms, the demand for seamless and secure access methods rises. The passive authentication market is likely to thrive as organizations leverage these technological advancements to enhance security protocols. It is anticipated that investments in infrastructure will lead to a more robust adoption of passive authentication technologies, ultimately improving overall cybersecurity posture in the region.