Expansion of Telemedicine Services

The expansion of telemedicine services in South America is reshaping the optical imaging market. As healthcare providers increasingly adopt telehealth solutions, the need for remote diagnostic tools becomes paramount. Optical imaging technologies that facilitate remote consultations and diagnostics are gaining popularity. This shift is likely to drive market growth, with estimates suggesting a potential increase of 12% in the adoption of optical imaging solutions by 2028. The integration of optical imaging into telemedicine not only enhances patient access to care but also supports healthcare professionals in delivering timely and accurate diagnoses.

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases in South America significantly impacts the optical imaging market. Conditions such as diabetes, cardiovascular diseases, and cancer necessitate advanced diagnostic tools for effective management and treatment. The demand for optical imaging technologies, which provide detailed insights into disease progression, is expected to rise. Reports suggest that the market for optical imaging solutions could grow by 20% in response to the increasing need for early diagnosis and monitoring of chronic conditions. This trend underscores the critical role of optical imaging in improving healthcare outcomes across the region.

Growing Research and Development Activities

The optical imaging market in South America benefits from a growing emphasis on research and development (R&D) activities. Academic institutions and private companies are increasingly collaborating to innovate and enhance imaging technologies. This focus on R&D is likely to lead to the introduction of novel optical imaging solutions, addressing specific regional healthcare challenges. For example, advancements in imaging techniques for early cancer detection are gaining attention. The R&D expenditure in this sector is projected to reach $500 million by 2026, indicating a robust commitment to advancing the optical imaging market in South America.

Rising Demand for Non-Invasive Diagnostic Tools

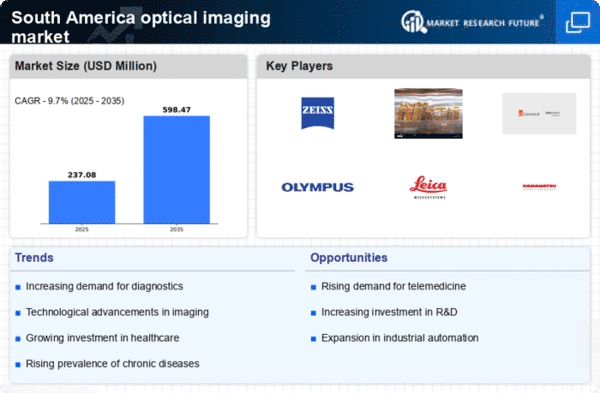

The optical imaging market in South America experiences a notable surge in demand for non-invasive diagnostic tools. This trend is primarily driven by the increasing awareness of patient comfort and the need for accurate diagnostics. Non-invasive techniques, such as optical coherence tomography (OCT) and fluorescence imaging, are gaining traction among healthcare providers. The market for these technologies is projected to grow at a CAGR of approximately 10% over the next five years. As healthcare facilities invest in advanced imaging technologies, the optical imaging market is likely to expand significantly, catering to the needs of both patients and practitioners.

Government Initiatives to Enhance Healthcare Infrastructure

In South America, government initiatives aimed at enhancing healthcare infrastructure play a crucial role in the optical imaging market. Various countries are allocating funds to improve medical facilities and access to advanced imaging technologies. For instance, Brazil's Ministry of Health has launched programs to integrate modern diagnostic tools into public healthcare systems. This investment is expected to increase the adoption of optical imaging technologies, with an estimated market growth of 15% by 2027. Such initiatives not only improve healthcare outcomes but also stimulate the optical imaging market, fostering innovation and accessibility.