Increasing Healthcare Expenditure

The rising healthcare expenditure in South America is a crucial driver for the MRSA drugs market. Governments and private sectors are investing more in healthcare infrastructure, which includes the procurement of advanced pharmaceuticals. In 2025, healthcare spending in the region is projected to reach approximately $1.5 trillion, reflecting a growth rate of around 6% annually. This increase in funding allows for better access to MRSA treatments, thereby potentially reducing the burden of infections. Enhanced healthcare facilities and improved access to medications are likely to contribute to the growth of the MRSA drugs market. Furthermore, as healthcare systems evolve, there is a growing emphasis on innovative therapies, which may lead to the introduction of new MRSA drugs, further stimulating market expansion.

Growing Demand for Personalized Medicine

The increasing demand for personalized medicine is emerging as a significant driver for the MRSA drugs market in South America. As healthcare shifts towards tailored treatments, there is a growing interest in developing drugs that cater to individual patient profiles, particularly for those with MRSA infections. By 2025, the personalized medicine market in the region is projected to grow at a CAGR of 10%, indicating a shift in treatment paradigms. This trend may lead to the development of targeted therapies that are more effective against specific strains of MRSA. Pharmaceutical companies are likely to invest in research to create personalized MRSA treatments, which could enhance patient adherence and outcomes. Consequently, this focus on personalized medicine may reshape the MRSA drugs market, driving innovation and improving therapeutic efficacy.

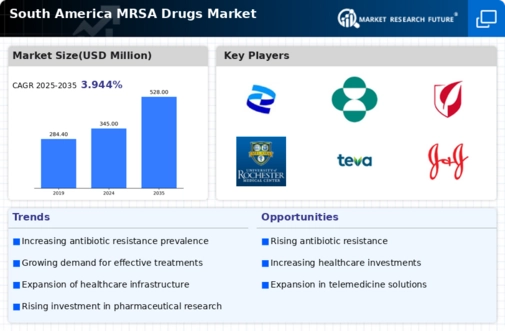

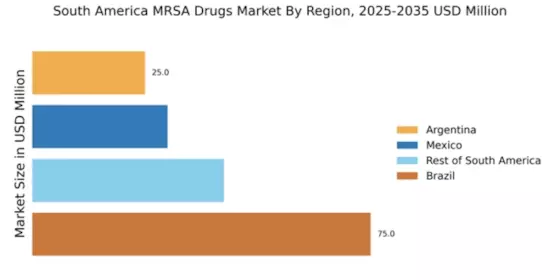

Expansion of Pharmaceutical Manufacturing

The expansion of pharmaceutical manufacturing capabilities in South America is a notable driver for the MRSA drugs market. Countries like Brazil and Argentina are enhancing their production facilities to meet the growing demand for antibiotics, including those targeting MRSA. In 2025, the region's pharmaceutical market is expected to reach $50 billion, with a significant portion allocated to the production of antibiotics. This growth is attributed to both local and international investments aimed at increasing production efficiency and reducing costs. As manufacturing capabilities improve, the availability of MRSA drugs is likely to increase, making treatments more accessible to healthcare providers and patients. Additionally, local production may lead to reduced prices, further stimulating the MRSA drugs market in South America.

Rising Awareness of Antibiotic Resistance

The growing awareness of antibiotic resistance among healthcare professionals and the general public is significantly impacting the MRSA drugs market in South America. Educational campaigns and initiatives by health organizations are highlighting the dangers of antibiotic misuse, which has led to increased demand for effective MRSA treatments. As of 2025, it is estimated that around 70% of healthcare providers in the region recognize the importance of addressing antibiotic resistance. This awareness is likely to drive the adoption of targeted therapies and novel antibiotics specifically designed to combat MRSA. Consequently, pharmaceutical companies may focus on research and development of new drugs, thereby enhancing the MRSA drugs market. The emphasis on responsible antibiotic use could also lead to more stringent regulations, further shaping the market landscape.

Government Initiatives for Infection Control

Government initiatives aimed at infection control are playing a pivotal role in shaping the MRSA drugs market in South America. Various health ministries are implementing strategies to combat the spread of MRSA infections, which include promoting the use of effective antibiotics and enhancing surveillance systems. In 2025, it is anticipated that government funding for infection control programs will exceed $200 million, reflecting a commitment to public health. These initiatives not only aim to reduce the incidence of MRSA but also encourage the development and distribution of new drugs. By fostering collaboration between public health authorities and pharmaceutical companies, these programs may lead to innovative solutions in the MRSA drugs market, ultimately improving patient outcomes.