Urbanization and Population Growth

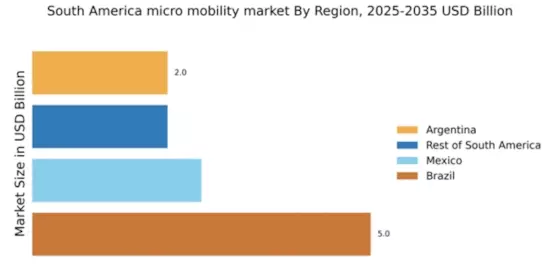

The rapid urbanization in South America is a crucial driver for the micro mobility market. As cities expand and populations increase, the demand for efficient transportation solutions intensifies. Urban areas are experiencing a surge in population density, leading to traffic congestion and a pressing need for alternative mobility options. The micro mobility market is poised to benefit from this trend, as individuals seek convenient and cost-effective means of transportation. In major cities like Sao Paulo and Buenos Aires, the population growth rate has been significant, with estimates suggesting an increase of over 10% in the last decade. This urban expansion creates a fertile ground for micro mobility solutions, as they offer flexibility and accessibility in navigating crowded urban landscapes.

Government Initiatives and Policy Support

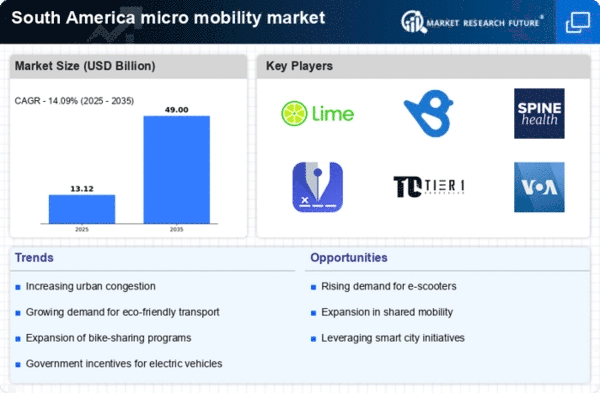

Government policies and initiatives play a pivotal role in shaping the micro mobility market in South America. Many governments are actively promoting the adoption of micro mobility solutions as part of their urban transport strategies. Incentives such as subsidies for electric vehicles and the establishment of dedicated bike lanes are becoming increasingly common. For instance, cities like Medellin and Santiago have implemented policies to encourage the use of electric scooters and bikes, aiming to reduce traffic congestion and improve air quality. These supportive measures are likely to foster a conducive environment for the micro mobility market, potentially leading to a market growth rate of around 15% over the next few years. The collaboration between public authorities and private operators is essential for the successful implementation of these initiatives.

Environmental Awareness and Sustainability

Growing environmental concerns among consumers in South America are driving the micro mobility market. As awareness of climate change and pollution rises, individuals are increasingly seeking sustainable transportation options. Micro mobility solutions, such as electric scooters and bikes, present an eco-friendly alternative to traditional vehicles. The market is witnessing a shift towards greener modes of transport, with studies indicating that micro mobility can reduce carbon emissions by up to 30% compared to conventional vehicles. This trend aligns with governmental initiatives aimed at promoting sustainable urban transport, further enhancing the appeal of micro mobility solutions. As cities implement policies to reduce vehicular emissions, the micro mobility market is likely to experience substantial growth.

Changing Consumer Preferences and Lifestyles

The evolving preferences and lifestyles of consumers in South America are significantly impacting the micro mobility market. As urban dwellers seek more flexible and convenient transportation options, micro mobility solutions are increasingly favored. The rise of the gig economy and remote work has altered commuting patterns, with many individuals opting for short-distance travel. This shift in consumer behavior is reflected in the growing popularity of shared mobility services, which offer on-demand access to scooters and bikes. Market data suggests that the usage of micro mobility services has increased by approximately 20% in urban areas over the past year. This trend indicates a strong inclination towards micro mobility as a viable alternative to traditional transport, further driving the growth of the market.

Technological Advancements in Mobility Solutions

Technological innovations are significantly influencing the micro mobility market in South America. The advent of smart technologies, such as mobile applications and GPS tracking, has enhanced the user experience and operational efficiency of micro mobility services. These advancements facilitate seamless access to vehicles, real-time tracking, and improved safety features. The integration of IoT (Internet of Things) in micro mobility solutions is also gaining traction, allowing for better fleet management and data analytics. As technology continues to evolve, the micro mobility market is expected to expand, with projections indicating a potential market growth of over 25% in the next five years. This technological evolution not only attracts users but also encourages investment in micro mobility infrastructure.