Enhanced Focus on Data Management

In the life sciences-bpo market, the emphasis on data management is becoming increasingly pronounced. With the rise of big data analytics, companies are recognizing the need for robust data handling capabilities. This trend is particularly relevant in South America, where regulatory requirements necessitate meticulous data management practices. The market for data management services is projected to grow by approximately 20% annually, as organizations seek to ensure compliance and enhance decision-making processes. BPO providers are stepping in to offer specialized data management solutions, which are essential for clinical trials and regulatory submissions. Consequently, this driver is likely to bolster the life sciences-bpo market significantly.

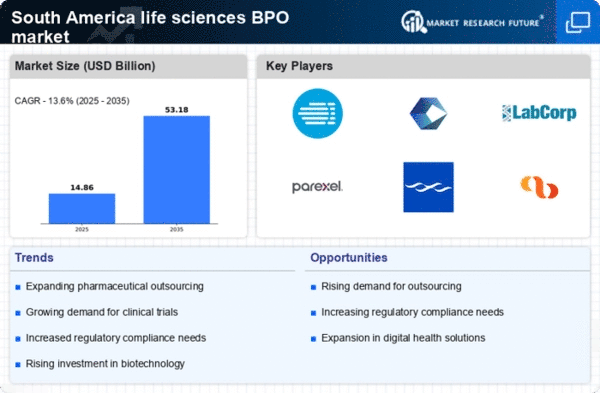

Growing Investment in Biotechnology

The life sciences-bpo market in South America is experiencing a surge in investment, particularly in biotechnology. This sector has attracted substantial funding, with estimates indicating that investments could reach $1.5 billion by 2026. The increasing focus on biopharmaceuticals and personalized medicine is driving this trend. Companies are seeking to outsource various functions, including research and development, to specialized BPO providers. This shift allows for enhanced efficiency and cost-effectiveness, enabling firms to allocate resources more strategically. As a result, the life sciences-bpo market is likely to expand, with biotechnology firms increasingly relying on BPO services to streamline operations and accelerate product development.

Rising Need for Specialized Services

The life sciences-bpo market is witnessing a growing demand for specialized services tailored to the unique needs of the industry. As companies in South America expand their operations, they require BPO providers that can offer expertise in areas such as regulatory affairs, clinical research, and pharmacovigilance. This trend is driven by the increasing complexity of regulatory requirements and the need for compliance with local and international standards. The market for specialized BPO services is expected to grow by around 15% annually, as organizations seek partners that can provide the necessary expertise and support. This driver is likely to enhance the overall landscape of the life sciences-bpo market.

Increasing Demand for Cost-Effective Solutions

Cost efficiency remains a critical driver in the life sciences-bpo market, particularly in South America. Companies are under constant pressure to reduce operational costs while maintaining high-quality standards. Outsourcing non-core functions to BPO providers allows organizations to achieve significant savings, with estimates suggesting that firms can reduce costs by up to 30% through outsourcing. This trend is particularly relevant for small to medium-sized enterprises that may lack the resources to manage all aspects of their operations in-house. As a result, the demand for cost-effective BPO solutions is likely to continue growing, further propelling the life sciences-bpo market in the region.

Expansion of Clinical Research Organizations (CROs)

The proliferation of Clinical Research Organizations (CROs) in South America is significantly impacting the life sciences-bpo market. As pharmaceutical and biotechnology companies seek to conduct clinical trials more efficiently, the demand for CRO services is on the rise. This trend is reflected in the projected growth of the CRO market, which is expected to reach $2 billion by 2027 in the region. BPO providers are increasingly collaborating with CROs to offer comprehensive solutions that encompass trial management, data collection, and regulatory compliance. This collaboration is likely to enhance the capabilities of the life sciences-bpo market, positioning it for sustained growth in the coming years.