Emergence of Innovative Startups

The life science-tools market in South America is witnessing the emergence of innovative startups that are reshaping the industry landscape. These startups are leveraging cutting-edge technologies to develop novel tools and solutions that address specific market needs. For instance, several companies are focusing on developing portable diagnostic devices that cater to remote areas, which is particularly relevant in a diverse region like South America. The influx of startup activity is expected to drive competition and foster innovation, potentially leading to a market growth rate of 18% over the next few years. This dynamic environment is likely to attract further investment and collaboration, enhancing the overall vitality of the life science-tools market.

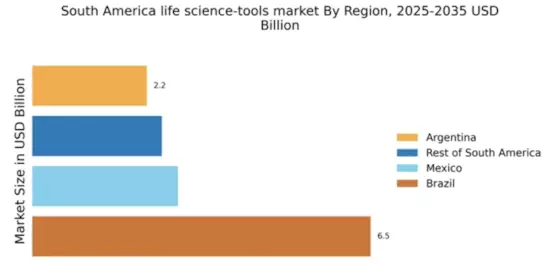

Expansion of Research Institutions

The life science-tools market in South America is benefiting from the expansion of research institutions across the region. Countries like Argentina and Chile are investing in new laboratories and research facilities, which are essential for advancing scientific knowledge. This expansion is expected to increase the demand for various life science tools, including laboratory equipment and reagents. With an estimated growth rate of 12% in the number of research institutions, the market is poised for significant development. As these institutions collaborate with industry partners, the life science-tools market is likely to see a rise in innovative products and services tailored to meet the needs of researchers.

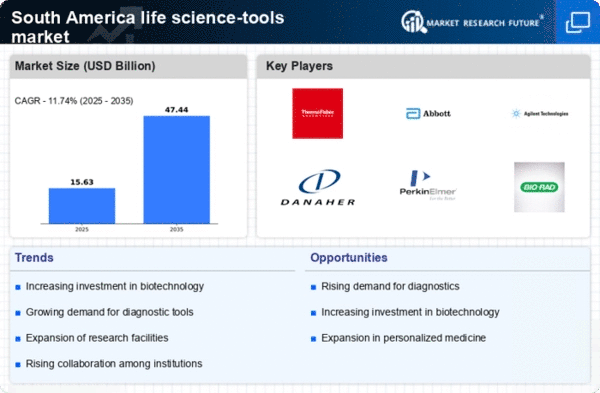

Rising Investment in Biotechnology

The life science-tools market in South America is experiencing a surge in investment, particularly in biotechnology. Governments and private sectors are increasingly allocating funds to enhance research and development capabilities. For instance, Brazil has seen a 15% increase in biotechnology funding over the past year, which is expected to bolster the life science-tools market. This influx of capital is likely to drive innovation and the development of advanced tools, thereby enhancing the overall market landscape. Furthermore, as the region aims to position itself as a leader in biotechnology, the demand for sophisticated life science tools is anticipated to grow, creating new opportunities for manufacturers and suppliers.

Growing Demand for Personalized Medicine

The life science-tools market in South America is significantly influenced by the rising demand for personalized medicine. As healthcare systems evolve, there is a notable shift towards tailored treatment plans that cater to individual patient needs. This trend is prompting an increase in the utilization of advanced diagnostic tools and technologies. For example, the market for genetic testing tools is projected to grow by 20% annually, reflecting the increasing focus on precision medicine. Consequently, the life science-tools market is likely to expand as healthcare providers seek innovative solutions to enhance patient outcomes and streamline treatment processes.

Increased Focus on Health and Safety Regulations

The life science-tools market in South America is being shaped by an increased focus on health and safety regulations. Governments are implementing stricter guidelines to ensure the quality and safety of life science products. This regulatory environment is driving manufacturers to invest in high-quality tools that comply with these standards. As a result, the market is witnessing a shift towards more reliable and efficient life science tools. The anticipated growth in regulatory compliance spending is expected to reach 10% annually, indicating a robust demand for tools that meet these evolving standards. This trend is likely to enhance the credibility and reliability of products within the life science-tools market.