Growing Aging Population

The demographic shift towards an aging population in South America significantly influences the South America Intraocular Lens Market. As the population ages, the prevalence of age-related eye conditions, such as cataracts and presbyopia, escalates. Reports indicate that by 2030, the number of individuals aged 60 and above in South America will exceed 200 million, creating a substantial demand for intraocular lenses. This demographic trend necessitates enhanced healthcare services and surgical interventions, thereby propelling the market for intraocular lenses. The increasing awareness of eye health among the elderly population further contributes to the growth of this market segment, as more individuals seek corrective solutions for their vision problems.

Rising Healthcare Expenditure

In South America, rising healthcare expenditure plays a pivotal role in shaping the South America Intraocular Lens Market. Governments and private sectors are increasingly investing in healthcare infrastructure, which includes the procurement of advanced medical devices such as intraocular lenses. For instance, Brazil and Argentina have reported significant increases in their healthcare budgets, with allocations for ophthalmic care rising by approximately 15% annually. This financial commitment facilitates access to modern surgical techniques and high-quality intraocular lenses, thereby enhancing patient outcomes. As healthcare systems evolve, the demand for innovative lens solutions is expected to rise, further stimulating market growth.

Increasing Awareness and Education

The South America Intraocular Lens Market benefits from increasing awareness and education regarding eye health and surgical options. Public health campaigns and initiatives by non-governmental organizations aim to educate the population about the importance of regular eye examinations and the availability of advanced intraocular lenses. This heightened awareness is particularly crucial in rural areas, where access to eye care services may be limited. As more individuals become informed about the benefits of intraocular lenses, the demand for cataract surgeries and lens implants is likely to increase. Consequently, this trend is expected to drive the market forward, as healthcare providers respond to the growing need for effective vision correction solutions.

Expansion of Ophthalmic Surgical Centers

The expansion of ophthalmic surgical centers across South America is a key driver for the South America Intraocular Lens Market. The establishment of specialized facilities dedicated to eye care enhances the accessibility and quality of cataract surgeries and lens implantation procedures. Countries like Colombia and Chile are witnessing a rise in the number of accredited surgical centers, which are equipped with state-of-the-art technology and skilled professionals. This proliferation of surgical centers not only improves patient access to intraocular lens procedures but also fosters competition among providers, leading to better service delivery and innovative treatment options. As these centers continue to expand, the market for intraocular lenses is poised for substantial growth.

Technological Innovations in Intraocular Lenses

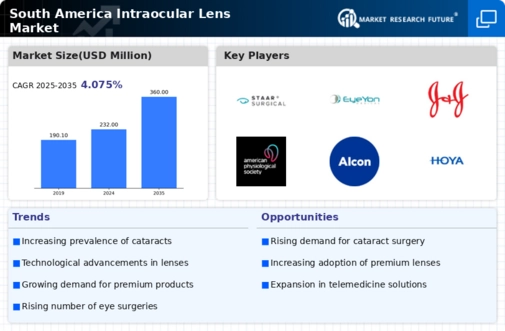

The South America Intraocular Lens Market is experiencing a surge in technological innovations, particularly in lens design and materials. Advanced manufacturing techniques, such as the use of biocompatible materials, enhance patient comfort and reduce complications. Notably, the introduction of premium intraocular lenses, including multifocal and toric lenses, caters to the diverse needs of patients with varying degrees of vision impairment. According to recent data, the market for premium lenses in South America is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years. This growth is indicative of the increasing demand for customized solutions that improve visual outcomes, thereby driving the overall market forward.