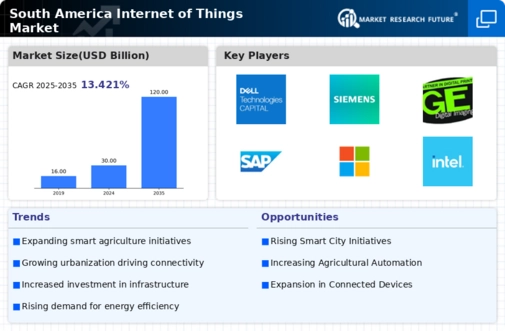

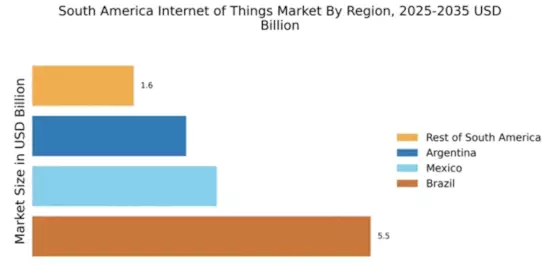

Brazil : Innovation and Investment Drive Growth

Brazil holds a dominant market share of 5.5% in the South American IoT sector, valued at approximately $1.5 billion. Key growth drivers include a robust digital infrastructure, increasing smartphone penetration, and government initiatives promoting smart cities. The demand for IoT solutions is rising in sectors like agriculture, healthcare, and manufacturing, supported by favorable regulatory policies aimed at enhancing technological adoption and innovation. The Brazilian government has launched several programs to foster IoT development, including tax incentives for tech startups and investments in broadband expansion. Key markets include São Paulo, Rio de Janeiro, and Brasília, where urbanization and industrial growth are significant. The competitive landscape features major players like Amazon, Microsoft, and IBM, which have established strong local partnerships. The business environment is characterized by a growing interest in smart home technologies and industrial IoT applications, particularly in logistics and supply chain management. As Brazil continues to invest in technology, the IoT market is expected to flourish, driven by both local and international players.

Mexico : Diverse Applications Fuel Market Growth

Mexico's IoT market is projected to capture a 3.0% share of the South American landscape, valued at around $800 million. Growth is driven by increasing investments in smart manufacturing and urban infrastructure, alongside a rising demand for connected devices in sectors such as automotive and healthcare. Government initiatives, including the National Digital Strategy, aim to enhance connectivity and promote IoT adoption across various industries. The regulatory environment is becoming more favorable, encouraging innovation and investment in technology. Key cities like Mexico City, Guadalajara, and Monterrey are pivotal in the IoT ecosystem, hosting numerous tech startups and established companies. The competitive landscape includes major players like Cisco and GE, which are actively involved in smart city projects. Local dynamics are characterized by a collaborative approach between government and private sectors, fostering an environment conducive to IoT development. The automotive industry, in particular, is leveraging IoT for enhanced manufacturing processes and supply chain efficiency, positioning Mexico as a key player in the region.

Argentina : Investment and Innovation on the Rise

Argentina's IoT market holds a 2.5% share of South America, valued at approximately $600 million. The growth is fueled by increasing investments in technology and a burgeoning startup ecosystem focused on IoT solutions. Demand trends indicate a rising interest in smart agriculture and energy management systems, supported by government initiatives aimed at promoting digital transformation. Regulatory policies are evolving to facilitate IoT adoption, with incentives for tech innovation and infrastructure development. Key markets include Buenos Aires, Córdoba, and Mendoza, where urbanization and industrial growth are driving IoT applications. The competitive landscape features local startups alongside international giants like IBM and Oracle, which are investing in local partnerships. The business environment is dynamic, with a focus on sustainability and efficiency in sectors such as agriculture and energy. As Argentina continues to embrace digital technologies, the IoT market is poised for significant growth, driven by both local innovation and international collaboration.

Rest of South America : Regional Growth and Collaboration

The Rest of South America accounts for a 1.65% share of the IoT market, valued at around $400 million. This sub-region includes countries like Chile, Colombia, and Peru, where growth is driven by increasing urbanization and a rising demand for smart solutions in various sectors. Government initiatives aimed at enhancing digital infrastructure and connectivity are pivotal in promoting IoT adoption. Regulatory frameworks are gradually improving, creating a conducive environment for technology investments. Key markets in this sub-region include Santiago, Bogotá, and Lima, where local governments are investing in smart city projects. The competitive landscape features a mix of local startups and international players like Siemens and Intel, which are exploring opportunities in renewable energy and smart agriculture. The business environment is characterized by collaboration between public and private sectors, fostering innovation and technology transfer. As these countries continue to develop their digital capabilities, the IoT market is expected to expand, driven by diverse applications and regional partnerships.