Emergence of 5G Technology

The rollout of 5G technology is set to revolutionize the intelligent network market in South America. With its promise of ultra-fast data speeds and low latency, 5G is anticipated to enable a new wave of applications, including autonomous vehicles and smart cities. The intelligent network market stands to benefit significantly from this technological advancement, as it facilitates the integration of various devices and systems. According to estimates, the 5G market in South America could reach $20 billion by 2025, highlighting the potential for growth. Telecommunications companies are investing heavily in 5G infrastructure, which is expected to enhance network capabilities and support the increasing demand for data. This transition to 5G not only improves connectivity but also drives innovation across multiple sectors, positioning the intelligent network market for substantial expansion in the coming years.

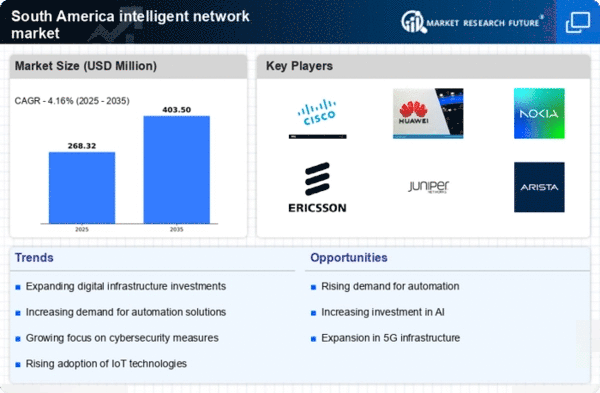

Rising Demand for Connectivity

The intelligent network market in South America experiences a notable surge in demand for enhanced connectivity solutions. As urbanization accelerates, cities are increasingly reliant on robust network infrastructures to support various applications, including IoT devices and smart transportation systems. This demand is reflected in the projected growth of the telecommunications sector, which is expected to reach approximately $100 billion by 2026. The need for seamless connectivity drives investments in intelligent networks, enabling efficient data transmission and real-time communication. Furthermore, the proliferation of mobile devices and the increasing number of internet users in the region contribute to this trend, as businesses and consumers alike seek reliable and high-speed network solutions. Consequently, the intelligent network market is poised for significant expansion, driven by the imperative for connectivity across diverse sectors.

Increased Focus on Cybersecurity

As the intelligent network market in South America expands, the focus on cybersecurity becomes increasingly paramount. With the rise of interconnected devices and systems, the potential for cyber threats escalates, prompting businesses and governments to prioritize security measures. The intelligent network market is responding to this challenge by integrating advanced cybersecurity solutions into network infrastructures. Investments in cybersecurity are projected to grow, with estimates suggesting a market size of $10 billion by 2027 in the region. This heightened emphasis on security not only protects sensitive data but also fosters consumer trust in intelligent network solutions. Moreover, regulatory requirements regarding data protection are driving organizations to adopt robust security protocols, further propelling the demand for secure intelligent networks. Consequently, the market is likely to evolve, with cybersecurity becoming a critical component of intelligent network strategies.

Adoption of Artificial Intelligence

The integration of artificial intelligence (AI) into the intelligent network market in South America is gaining momentum. AI technologies are being utilized to optimize network performance, enhance decision-making processes, and improve user experiences. The intelligent network market is witnessing a shift towards AI-driven solutions that enable predictive analytics and automated network management. This trend is supported by the increasing availability of data and advancements in machine learning algorithms. As organizations seek to leverage AI for operational efficiency, the market for AI in networking is projected to grow significantly, potentially reaching $5 billion by 2026. The adoption of AI not only streamlines network operations but also facilitates the development of smart applications that can adapt to user needs. Thus, the intelligent network market is likely to experience transformative changes as AI continues to play a pivotal role in shaping its future.

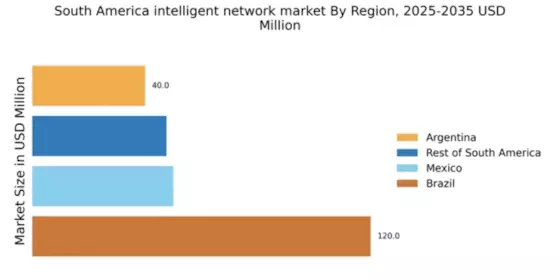

Government Initiatives and Policies

Government initiatives play a crucial role in shaping the intelligent network market in South America. Various countries in the region are implementing policies aimed at fostering technological innovation and digital transformation. For instance, Brazil's National Broadband Plan aims to expand internet access to underserved areas, thereby stimulating demand for intelligent network solutions. Additionally, regulatory frameworks that promote competition among service providers are likely to enhance service quality and reduce costs for consumers. The intelligent network market benefits from these initiatives, as they create a conducive environment for investment and development. Furthermore, public-private partnerships are emerging as a strategy to accelerate infrastructure development, which is essential for the growth of intelligent networks. As a result, the market is expected to witness increased activity and investment, driven by supportive government policies.