Growing Demand for Point-of-Care Testing

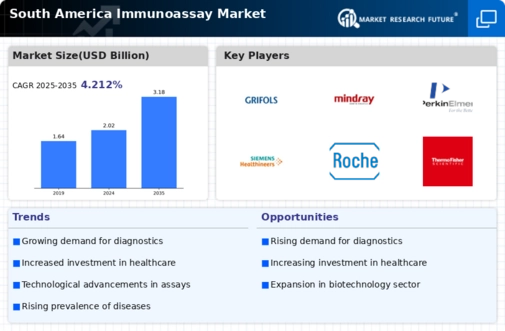

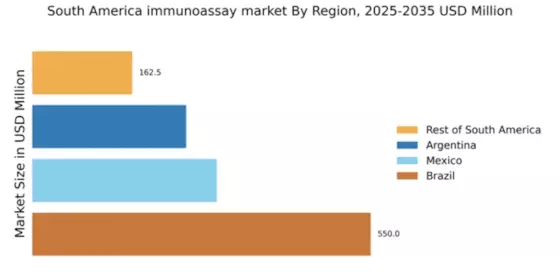

The increasing demand for point-of-care testing (POCT) in South America is a pivotal driver for the immunoassay market. POCT offers rapid results, which is crucial in emergency and primary care settings. This trend is particularly pronounced in countries like Brazil and Argentina, where healthcare accessibility remains a challenge. The convenience of POCT devices, which can be used in various settings, is likely to enhance patient outcomes. The immunoassay market in South America is projected to grow at a CAGR of approximately 8% from 2025 to 2030, driven by the rising adoption of these technologies. As healthcare providers seek to improve diagnostic efficiency, the demand for innovative immunoassay solutions is expected to rise, further propelling market growth.

Rising Awareness of Preventive Healthcare

The growing awareness of preventive healthcare in South America is a crucial driver for the immunoassay market. As populations become more health-conscious, there is an increasing emphasis on early detection and prevention of diseases. This trend is particularly evident in urban areas, where health campaigns and education initiatives are prevalent. The immunoassay market is likely to benefit from this shift, as more individuals seek out diagnostic tests for early disease identification. The market is projected to expand as healthcare providers incorporate immunoassay tests into routine check-ups, potentially increasing the market share by 15% over the next five years. This proactive approach to health management is expected to drive demand for immunoassay products.

Focus on Research and Development Initiatives

The emphasis on research and development (R&D) initiatives in South America is a significant driver for the immunoassay market. Academic institutions and private companies are increasingly collaborating to innovate and develop new immunoassay technologies. This focus on R&D is likely to yield novel diagnostic solutions that cater to the specific health challenges faced in the region. For example, the Brazilian government has allocated approximately $50 million for health-related research in 2025, which is expected to bolster the immunoassay sector. As new products emerge from these initiatives, the market is poised for expansion, with potential increases in market share as innovative solutions become available.

Technological Integration in Healthcare Systems

The integration of advanced technologies into healthcare systems in South America is shaping the immunoassay market. The adoption of electronic health records (EHR) and telemedicine is facilitating better data management and patient monitoring. This technological evolution allows for more efficient use of immunoassay tests, as healthcare providers can easily access patient histories and test results. The market is likely to see a surge in demand for immunoassay products that are compatible with these technologies. As healthcare systems become more interconnected, the potential for improved patient outcomes through timely and accurate diagnostics is substantial, suggesting a robust growth trajectory for the immunoassay market.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is significantly influencing the immunoassay market. Governments and private entities are channeling funds into modernizing laboratories and healthcare facilities, which enhances the capacity for advanced diagnostic testing. For instance, Brazil's healthcare expenditure is anticipated to reach $200 billion by 2026, reflecting a commitment to improving healthcare services. This influx of capital is likely to facilitate the acquisition of sophisticated immunoassay technologies, thereby expanding the market. Enhanced infrastructure not only improves testing capabilities but also fosters research and development in the immunoassay sector, potentially leading to innovative products that meet local healthcare needs.