Increasing Health Awareness

The South America Health And Wellness Product Market is experiencing a notable surge in health consciousness among consumers. This trend is driven by a growing understanding of the importance of nutrition and physical activity. According to recent surveys, approximately 70% of South Americans are actively seeking healthier lifestyle choices, which has led to an increased demand for organic foods, dietary supplements, and fitness products. This heightened awareness is not only influencing purchasing decisions but also prompting companies to innovate and diversify their product offerings. As a result, the market is witnessing a proliferation of health-focused brands and products, catering to the evolving preferences of health-conscious consumers. The emphasis on preventive healthcare is likely to further bolster the growth of the South America Health And Wellness Product Market.

Focus on Preventive Healthcare

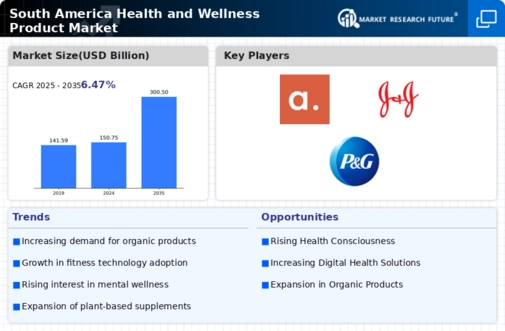

The South America Health And Wellness Product Market is increasingly aligning with the global shift towards preventive healthcare. Consumers are becoming more proactive about their health, seeking products that not only address existing health issues but also prevent potential ailments. This trend is reflected in the rising popularity of supplements, functional foods, and wellness programs that promote overall well-being. Data suggests that the preventive healthcare market in South America is projected to grow at a compound annual growth rate (CAGR) of 8% over the next five years. This growth is indicative of a broader cultural shift towards holistic health approaches, where consumers prioritize long-term health benefits over short-term solutions. As a result, businesses in the health and wellness sector are likely to adapt their strategies to meet this evolving consumer demand.

Growth of E-commerce Platforms

The rise of e-commerce is transforming the South America Health And Wellness Product Market, providing consumers with unprecedented access to a wide array of health products. Online shopping has gained immense popularity, with a significant percentage of consumers preferring to purchase health and wellness products through digital platforms. This shift is supported by the increasing penetration of smartphones and internet connectivity across the region. According to recent data, e-commerce sales in the health and wellness sector have grown by over 30% in the past year alone. This trend not only facilitates convenience for consumers but also allows brands to reach a broader audience, thereby enhancing market competition and innovation. The expansion of e-commerce is likely to continue shaping the dynamics of the South America Health And Wellness Product Market.

Rising Demand for Natural Ingredients

There is a discernible shift towards natural and organic ingredients within the South America Health And Wellness Product Market. Consumers are increasingly wary of synthetic additives and are opting for products that boast natural formulations. This trend is particularly evident in the beauty and personal care segments, where products containing plant-based ingredients are gaining traction. Market Research Future indicates that the demand for natural health products has surged by approximately 25% in recent years, reflecting a broader global movement towards clean and sustainable living. Companies are responding by reformulating existing products and launching new lines that emphasize transparency and ingredient integrity. This growing preference for natural ingredients is likely to play a pivotal role in shaping the future landscape of the South America Health And Wellness Product Market.

Government Initiatives and Regulations

Government policies in South America are increasingly supporting the health and wellness sector, thereby positively impacting the South America Health And Wellness Product Market. Various countries are implementing regulations that promote the consumption of healthier products and discourage the use of harmful substances. For instance, Brazil has introduced initiatives aimed at reducing sugar and salt in processed foods, which encourages manufacturers to reformulate their products. Additionally, public health campaigns are being launched to educate citizens about nutrition and wellness, further driving demand for health-oriented products. These regulatory frameworks not only enhance consumer trust but also create a conducive environment for businesses to thrive, potentially leading to a more robust market landscape.