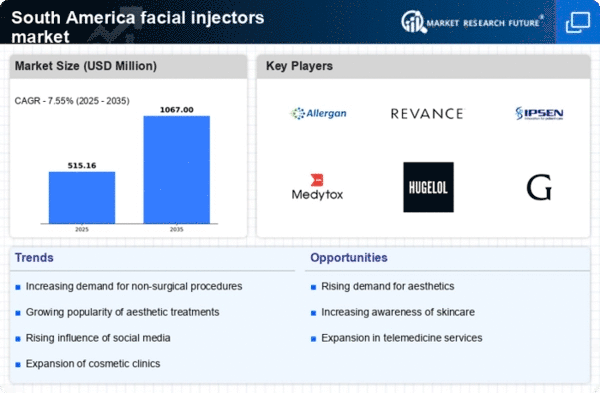

Brazil : Brazil's Robust Growth in Aesthetics

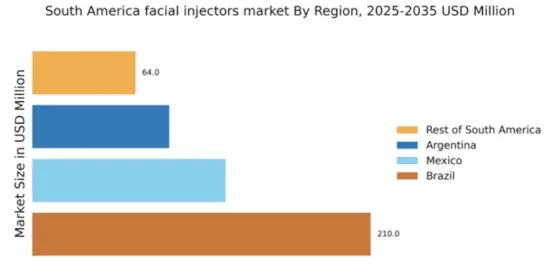

Brazil holds a commanding market share of 45.5% in the South American facial injectors market, valued at $210.0 million. Key growth drivers include a rising demand for aesthetic procedures, fueled by increasing disposable incomes and a cultural emphasis on beauty. Regulatory support from ANVISA has streamlined the approval process for new products, while urbanization and improved healthcare infrastructure further bolster market growth. The trend towards minimally invasive procedures is also gaining traction, reflecting changing consumer preferences. Key cities such as São Paulo, Rio de Janeiro, and Brasília are pivotal markets, showcasing a competitive landscape dominated by major players like Allergan and Galderma. The presence of numerous aesthetic clinics and dermatology practices enhances accessibility to facial injectors. Local dynamics favor innovative product offerings, with a growing interest in non-surgical enhancements. The business environment is increasingly favorable, supported by government initiatives promoting health and wellness.

Mexico : Mexico's Aesthetic Revolution Underway

Mexico accounts for 25.5% of the South American facial injectors market, valued at $120.0 million. The market is driven by a youthful population increasingly interested in aesthetic enhancements, alongside a growing medical tourism sector. Regulatory frameworks are evolving, with COFEPRIS actively working to ensure product safety and efficacy. The rise of social media influences consumer choices, leading to higher demand for facial injectors as beauty standards shift. Key markets include Mexico City, Guadalajara, and Monterrey, where a mix of local and international players like Revance Therapeutics and Ipsen are establishing a foothold. The competitive landscape is characterized by a blend of established brands and emerging startups, fostering innovation. The local business environment is dynamic, with increasing investments in aesthetic clinics and training programs for practitioners, enhancing service quality and consumer trust.

Argentina : Argentina's Resilient Aesthetic Market

Argentina holds a 18.5% share of the South American facial injectors market, valued at $85.0 million. Despite economic fluctuations, the demand for aesthetic procedures remains strong, driven by a cultural affinity for beauty and self-care. Government initiatives aimed at improving healthcare access and regulatory clarity are fostering market growth. The increasing popularity of non-surgical treatments is evident, as consumers seek affordable yet effective solutions. Key cities such as Buenos Aires, Córdoba, and Rosario are central to market activity, with major players like Galderma and Allergan leading the charge. The competitive landscape is marked by a mix of local clinics and international brands, creating a diverse offering for consumers. The business environment is challenging yet promising, with a growing number of aesthetic professionals and clinics catering to the rising demand for facial injectors, particularly among younger demographics.

Rest of South America : Varied Growth Across South America

The Rest of South America represents a 14.5% share of the facial injectors market, valued at $64.0 million. This sub-region encompasses diverse markets, each with unique growth drivers, including increasing disposable incomes and a rising interest in aesthetic procedures. Regulatory bodies are gradually adapting to the growing demand, ensuring product safety and efficacy. The trend towards minimally invasive treatments is also gaining traction across various countries in this sub-region. Key markets include Chile, Colombia, and Peru, where local players and international brands like Medytox and Sientra are competing. The competitive landscape is fragmented, with a mix of established and emerging companies. Local dynamics vary significantly, influenced by cultural attitudes towards beauty and healthcare access. The business environment is evolving, with increasing investments in aesthetic clinics and training, enhancing the overall market landscape.