Rising Electric Vehicle Adoption

The increasing adoption of electric vehicles in South America is a pivotal driver for the Electric Vehicle Ev Charging Infrastructure Market. According to recent data, electric vehicle sales in Brazil have seen a year-on-year growth of over 50%, reflecting a growing consumer preference for sustainable transportation options. This trend is further supported by the rising awareness of environmental issues and the need for cleaner alternatives to fossil fuels. As more consumers transition to electric vehicles, the demand for accessible and efficient charging infrastructure becomes paramount. Consequently, the market is likely to witness a proliferation of charging stations, catering to the needs of an expanding electric vehicle user base, thereby enhancing the overall infrastructure landscape.

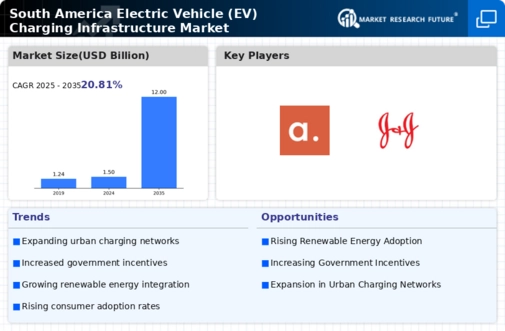

Government Support and Incentives

The South America Electric Vehicle Ev Charging Infrastructure Market is experiencing a surge in government support and incentives aimed at promoting electric vehicle adoption. Countries like Brazil and Argentina have implemented tax breaks and subsidies for electric vehicle purchases, which indirectly boosts the demand for charging infrastructure. For instance, Brazil's National Electric Mobility Plan outlines a roadmap for expanding charging networks, indicating a commitment to sustainable transportation. This governmental backing not only enhances consumer confidence but also encourages private investments in charging stations, thereby accelerating the growth of the infrastructure market. As a result, the synergy between government initiatives and market dynamics is likely to foster a robust environment for electric vehicle charging solutions across the region.

Public Awareness and Environmental Concerns

Growing public awareness regarding environmental issues is a crucial driver for the South America Electric Vehicle Ev Charging Infrastructure Market. As citizens become more informed about the impacts of climate change and air pollution, there is a noticeable shift towards sustainable practices, including the adoption of electric vehicles. Campaigns promoting the benefits of electric mobility are gaining traction, further encouraging consumers to consider electric vehicles as viable alternatives. This heightened awareness is likely to stimulate demand for charging infrastructure, as consumers seek convenient and accessible charging options. Consequently, the interplay between public sentiment and market dynamics is expected to play a significant role in shaping the future of electric vehicle charging solutions in South America.

Urbanization and Infrastructure Development

Rapid urbanization in South America is driving the demand for electric vehicle charging infrastructure. As cities expand and populations grow, the need for sustainable transportation solutions becomes increasingly critical. Urban centers like Santiago and Buenos Aires are witnessing significant investments in public transportation and electric vehicle infrastructure. The South America Electric Vehicle Ev Charging Infrastructure Market is likely to benefit from these developments, as municipalities prioritize the installation of charging stations in urban areas. This focus on infrastructure development not only supports electric vehicle adoption but also aligns with broader sustainability goals, potentially leading to a more integrated and efficient transportation network across the region.

Technological Innovations in Charging Solutions

Technological advancements in charging solutions are significantly influencing the South America Electric Vehicle Ev Charging Infrastructure Market. Innovations such as fast-charging stations and wireless charging technologies are becoming increasingly prevalent, enhancing the convenience and efficiency of electric vehicle charging. For example, the introduction of ultra-fast charging stations can reduce charging times to under 30 minutes, making electric vehicles more appealing to consumers. Furthermore, the integration of smart grid technologies allows for better energy management and optimization of charging processes. These technological improvements not only enhance user experience but also attract investments from both public and private sectors, thereby propelling the growth of the charging infrastructure market in South America.