Emergence of Hybrid Cloud Environments

Hybrid cloud environments are emerging as a catalyst for the data virtualization market in South America. Organizations are increasingly adopting hybrid cloud strategies to balance the benefits of public and private cloud solutions. Data virtualization plays a pivotal role in this context, enabling seamless data integration and management across diverse cloud environments. As businesses seek to optimize their cloud investments, the demand for data virtualization solutions is expected to rise. Analysts project that the hybrid cloud market in South America will grow at a CAGR of 20% over the next few years, further enhancing the relevance of data virtualization technologies.

Rising Demand for Real-Time Data Access

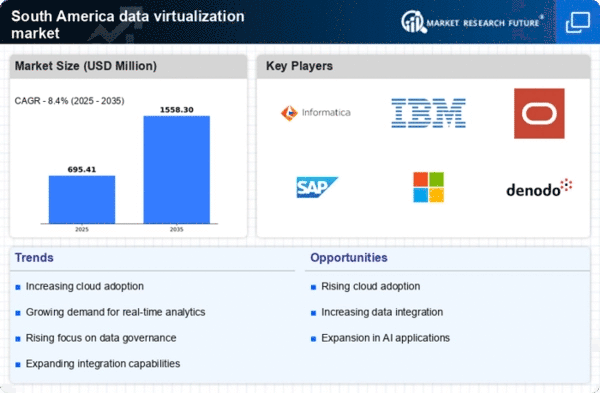

The The data virtualization market in South America is experiencing a notable surge in demand for real-time data access.. Organizations are increasingly recognizing the necessity of timely information to make informed decisions. This trend is particularly evident in sectors such as finance and retail, where the ability to access and analyze data in real-time can lead to competitive advantages. According to recent estimates, the market for data virtualization solutions in South America is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for businesses to respond swiftly to market changes and customer preferences, thereby enhancing operational efficiency and customer satisfaction.

Increased Investment in IT Infrastructure

Increased investment in IT infrastructure significantly impacts the data virtualization market in South America. As businesses recognize the need for advanced technological solutions, they are allocating substantial budgets towards enhancing their data management capabilities. This trend is particularly pronounced in sectors such as healthcare and manufacturing, where efficient data handling is crucial. Reports suggest that IT spending in South America is expected to reach $150 billion by 2025, with a considerable portion directed towards data virtualization solutions. This investment is likely to foster innovation and improve data accessibility, thereby driving market growth.

Expansion of Digital Transformation Initiatives

The ongoing digital transformation initiatives across various industries in South America significantly influence the data virtualization market. As organizations strive to modernize their IT infrastructure, the integration of data virtualization solutions becomes essential. These solutions facilitate seamless data integration from disparate sources, enabling businesses to harness the full potential of their data assets. The data virtualization market in South America is projected to witness substantial growth, with an estimated value reaching $500 million by 2026. This expansion is largely attributed to the increasing investments in technology and the growing recognition of data as a strategic asset.

Growing Importance of Data-Driven Decision Making

In South America, the growing importance of data-driven decision making is a key driver for the data virtualization market. Organizations are increasingly leveraging data analytics to enhance their strategic planning and operational processes. This shift towards data-centric approaches necessitates robust data virtualization solutions that can provide a unified view of data across various platforms. As businesses aim to improve their decision-making capabilities, the demand for data virtualization technologies is likely to rise. Recent surveys indicate that approximately 70% of companies in South America are prioritizing data analytics initiatives, further propelling the growth of the data virtualization market.