Rising Demand for Customization

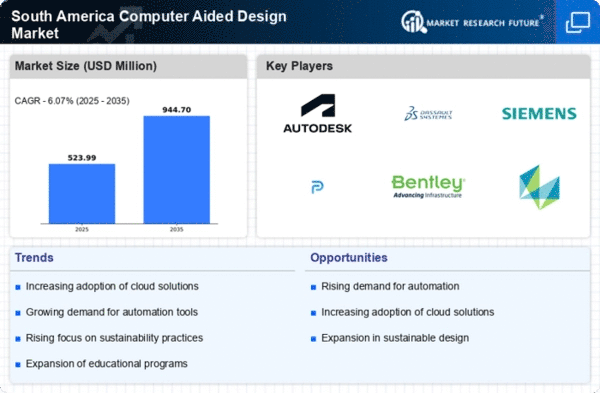

The computer aided-design market in South America experiences a notable increase in demand for customized solutions across various industries. This trend is driven by the need for tailored products that meet specific consumer preferences. Industries such as automotive, architecture, and consumer electronics are increasingly adopting CAD tools to create unique designs that resonate with local markets. As a result, the market is projected to grow at a CAGR of approximately 8.5% from 2025 to 2030. This customization trend not only enhances customer satisfaction but also fosters innovation within the computer aided-design market, as companies strive to differentiate their offerings.

Growth of the Construction Sector

The construction sector in South America is witnessing robust growth, which significantly influences the computer aided-design market. With urbanization and infrastructure development on the rise, there is an increasing need for advanced design tools to facilitate efficient project planning and execution. CAD software enables architects and engineers to create detailed models, improving accuracy and reducing costs. The construction industry's expansion is projected to drive the CAD market in South America, with an estimated growth rate of 9% over the next five years. This growth underscores the importance of CAD solutions in meeting the demands of a rapidly evolving construction landscape.

Government Initiatives and Support

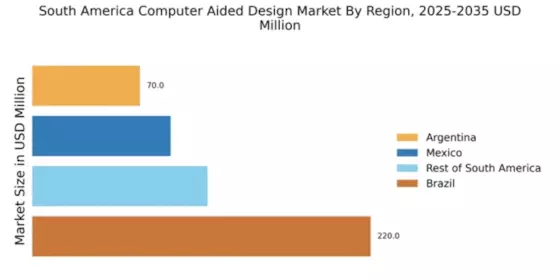

Government initiatives in South America play a crucial role in promoting the computer aided-design market. Various countries are investing in technology infrastructure and providing incentives for businesses to adopt advanced design tools. For instance, Brazil's government has launched programs aimed at enhancing technological capabilities in manufacturing sectors, which directly impacts the adoption of CAD solutions. These initiatives are expected to contribute to a market growth rate of around 7% annually, as more companies leverage government support to integrate CAD technologies into their operations, thereby improving efficiency and productivity.

Increased Focus on Education and Training

An increased focus on education and training in design technologies is emerging as a key driver for the computer aided-design market in South America. Educational institutions are incorporating CAD training into their curricula, equipping students with essential skills for the workforce. This emphasis on education is fostering a new generation of designers proficient in CAD tools, which is likely to enhance the overall market landscape. As more professionals enter the field with advanced skills, the demand for CAD software is expected to rise, potentially leading to a market growth rate of around 6% over the next few years.

Technological Advancements in CAD Software

Technological advancements in CAD software are reshaping the computer aided-design market in South America. Innovations such as cloud-based solutions, 3D modeling, and virtual reality integration are enhancing the capabilities of CAD tools. These advancements allow for more efficient design processes and improved collaboration among teams. As companies increasingly adopt these technologies, the market is expected to grow by approximately 10% annually. This growth reflects the industry's response to the need for more sophisticated design solutions that can keep pace with the evolving demands of various sectors, including manufacturing and engineering.