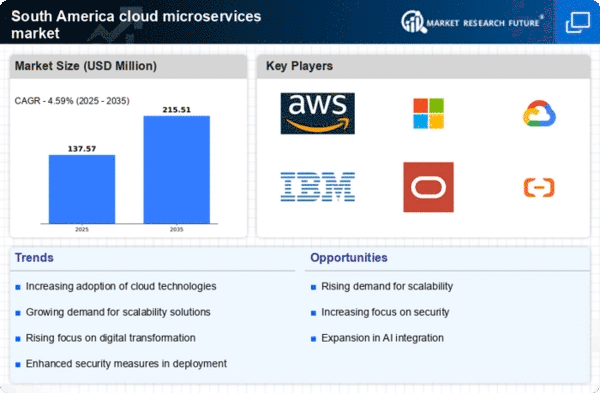

Rising Demand for Scalability

The cloud microservices market in South America experiences a notable surge in demand for scalability solutions. As businesses expand, they require systems that can efficiently scale operations without significant downtime. This demand is driven by the need for agile responses to market changes and customer preferences. According to recent data, approximately 65% of organizations in South America prioritize scalability in their cloud strategies. This trend indicates a shift towards microservices architecture, which allows for modular development and deployment. Companies are increasingly adopting cloud microservices to enhance their operational efficiency and reduce costs. The ability to scale resources dynamically is becoming a critical factor for businesses aiming to maintain competitiveness in a rapidly evolving market. Thus, the rising demand for scalability is a key driver in the cloud microservices market.

Enhanced Collaboration and Innovation

The cloud microservices market in South America is witnessing enhanced collaboration and innovation as a key driver. Organizations are increasingly adopting microservices to foster a culture of collaboration among development teams. This architectural style allows for independent development and deployment of services, which can lead to faster innovation cycles. Data indicates that companies utilizing microservices report a 50% increase in their ability to innovate and respond to market changes. By breaking down silos and encouraging cross-functional teamwork, businesses can leverage diverse skill sets to create more robust solutions. This collaborative environment not only accelerates product development but also enhances the overall quality of services offered. Therefore, enhanced collaboration and innovation emerge as crucial drivers in the cloud microservices market, shaping the future landscape of technology in South America.

Growing Emphasis on Customer Experience

In the cloud microservices market in South America, there is a growing emphasis on enhancing customer experience. Businesses are increasingly aware that delivering superior customer service is essential for retaining clients and attracting new ones. Microservices architecture enables organizations to develop and deploy applications that are more responsive to customer needs. By leveraging microservices, companies can implement features and updates more rapidly, thereby improving user satisfaction. Recent surveys indicate that 80% of South American consumers prioritize seamless digital experiences, prompting businesses to adapt their strategies accordingly. This focus on customer experience is likely to drive the adoption of microservices, as organizations seek to create more personalized and efficient interactions. Thus, the growing emphasis on customer experience is a significant driver in the cloud microservices market.

Cost Efficiency and Resource Optimization

Cost efficiency remains a pivotal driver in the cloud microservices market in South America. Organizations are increasingly seeking ways to optimize their IT expenditures while maintaining high service levels. The adoption of microservices allows companies to break down applications into smaller, manageable components, which can lead to significant cost savings. Recent studies indicate that businesses can reduce operational costs by up to 30% through the implementation of microservices. This approach not only minimizes resource wastage but also enhances the overall performance of applications. As companies strive to maximize their return on investment, the focus on cost efficiency and resource optimization is likely to propel the growth of the cloud microservices market. The financial benefits associated with this model are compelling, making it an attractive option for organizations across various sectors.

Increased Focus on Digital Transformation

The ongoing digital transformation initiatives across South America are significantly influencing the cloud microservices market. Organizations are increasingly recognizing the need to modernize their IT infrastructure to remain competitive. This transformation often involves migrating to cloud-based solutions, where microservices play a crucial role. By adopting microservices, companies can enhance their agility and responsiveness to market demands. Data suggests that around 70% of enterprises in South America are currently engaged in some form of digital transformation, with a substantial portion integrating microservices into their strategies. This trend indicates a broader shift towards innovative technologies that facilitate faster deployment and improved customer experiences. Consequently, the increased focus on digital transformation serves as a vital driver in the cloud microservices market, shaping the future of business operations.