Rising Healthcare Expenditure

Rising healthcare expenditure in South America is a significant driver for the chronic inflammatory-demyelinating-polyneuropathy market. As countries in the region allocate more resources to healthcare, the availability of advanced treatment options for CIDP is improving. For example, healthcare spending in Argentina has increased by approximately 8% annually, allowing for better access to medications and therapies for chronic inflammatory-demyelinating-polyneuropathy. This increase in expenditure is also facilitating the introduction of innovative therapies and clinical trials, which are essential for advancing treatment options. As healthcare budgets continue to grow, the chronic inflammatory-demyelinating-polyneuropathy market is likely to benefit from enhanced research funding and improved patient care.

Investment in Healthcare Infrastructure

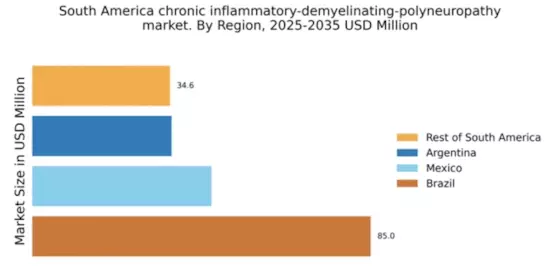

Investment in healthcare infrastructure is a crucial driver for the chronic inflammatory-demyelinating-polyneuropathy market in South America. Governments and private entities are increasingly allocating funds to enhance healthcare facilities, particularly in underserved areas. For instance, Brazil has committed to investing over $10 billion in healthcare infrastructure improvements over the next five years. This investment aims to improve access to specialized care for patients with chronic inflammatory-demyelinating-polyneuropathy, facilitating timely diagnosis and treatment. Enhanced infrastructure not only supports the delivery of advanced therapies but also encourages research and development initiatives focused on CIDP. As healthcare systems evolve, the chronic inflammatory-demyelinating-polyneuropathy market is likely to benefit from improved patient outcomes and increased treatment accessibility.

Growing Demand for Personalized Medicine

The chronic inflammatory-demyelinating-polyneuropathy market in South America is witnessing a shift towards personalized medicine, which is becoming increasingly important in the treatment of CIDP. Tailored therapies that consider individual patient characteristics, such as genetic makeup and disease severity, are gaining traction. This trend is supported by advancements in biomarker research, which may enhance the ability to predict treatment responses. The market for personalized medicine is projected to grow at a CAGR of 10% in the region, reflecting the increasing recognition of the need for customized treatment approaches. As healthcare providers adopt more personalized strategies, the chronic inflammatory-demyelinating-polyneuropathy market is expected to expand, offering patients more effective and targeted therapies.

Increasing Prevalence of Neurological Disorders

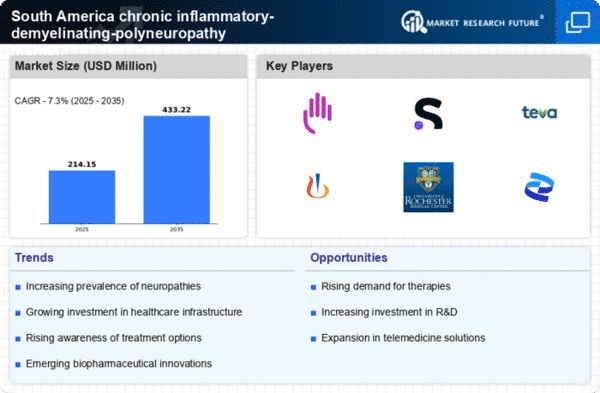

The chronic inflammatory-demyelinating-polyneuropathy market in South America is experiencing growth due to the rising prevalence of neurological disorders. Recent studies indicate that the incidence of chronic inflammatory-demyelinating-polyneuropathy (CIDP) is increasing, with estimates suggesting that approximately 1.5 to 2.5 cases per 100,000 individuals are diagnosed annually. This growing patient population necessitates enhanced healthcare services and treatment options, thereby driving market expansion. Furthermore, the aging population in South America, which is projected to reach 15% by 2030, contributes to the higher incidence of CIDP, as older adults are more susceptible to neurological conditions. Consequently, healthcare providers are focusing on improving diagnostic capabilities and treatment protocols, which is likely to bolster the chronic inflammatory-demyelinating-polyneuropathy market in the region.

Collaboration Between Public and Private Sectors

Collaboration between public and private sectors is emerging as a vital driver for the chronic inflammatory-demyelinating-polyneuropathy market in South America. Partnerships between government agencies, healthcare providers, and pharmaceutical companies are fostering innovation and improving access to treatments. For instance, joint initiatives aimed at increasing awareness and education about CIDP are being implemented, which may lead to earlier diagnosis and intervention. Additionally, collaborative research efforts are likely to accelerate the development of new therapies, addressing unmet medical needs in the chronic inflammatory-demyelinating-polyneuropathy market. As these partnerships strengthen, they could enhance the overall healthcare landscape, ultimately benefiting patients and healthcare systems across the region.