Growing Aging Population

The demographic shift towards an aging population in South America is poised to have a profound impact on the cholesterol test market. As individuals age, the risk of developing high cholesterol and related health complications increases. Current projections indicate that by 2030, the population aged 60 and above in South America will exceed 20% of the total population. This demographic trend is likely to lead to a higher demand for cholesterol testing, as older adults are more likely to require regular monitoring of their cholesterol levels. Healthcare providers are adapting to this shift by offering tailored screening programs for seniors, which may include home testing options. Consequently, the cholesterol test market is expected to expand as healthcare systems prioritize the needs of the aging population, ensuring that cholesterol testing becomes an integral part of routine health assessments.

Government Health Initiatives

Government initiatives aimed at improving public health in South America are significantly influencing the cholesterol test market. Various countries in the region have launched campaigns to promote awareness about the dangers of high cholesterol and its link to heart disease. These initiatives often include subsidized health screenings and educational programs that encourage individuals to monitor their cholesterol levels regularly. For instance, some governments have allocated budgets exceeding $10 million annually to support these health programs. Such investments not only enhance public awareness but also facilitate access to cholesterol testing services, thereby driving market growth. The cholesterol test market is likely to benefit from these government efforts, as they create a supportive environment for increased testing and early detection of cholesterol-related health issues.

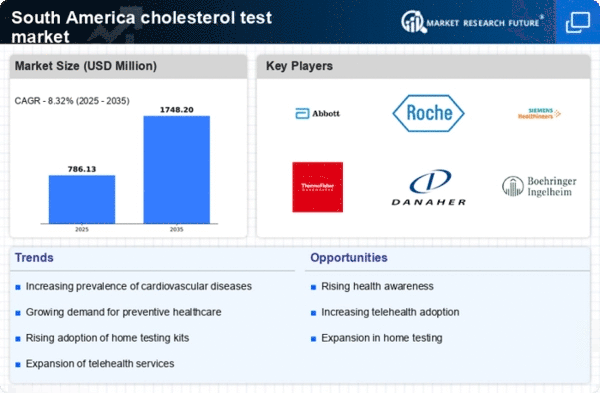

Rising Demand for Home Testing Kits

The trend towards self-monitoring health has led to a rising demand for home cholesterol testing kits in South America. As consumers become more health-conscious, they are increasingly seeking convenient and private options for monitoring their cholesterol levels. The market for home testing kits has seen a notable increase, with sales growing by approximately 20% annually. This shift is driven by the desire for immediate results and the ability to track health metrics without the need for frequent visits to healthcare facilities. The cholesterol test market is likely to benefit from this trend, as manufacturers innovate and develop user-friendly testing kits that cater to the needs of consumers. The convenience of home testing may encourage more individuals to take charge of their health, leading to increased testing frequency and improved cholesterol management.

Rising Incidence of Cardiovascular Diseases

The increasing prevalence of cardiovascular diseases in South America is a critical driver for the cholesterol test market. According to health statistics, cardiovascular diseases account for a significant portion of mortality in the region, with estimates suggesting that they contribute to over 30% of deaths annually. This alarming trend has heightened public awareness regarding heart health, prompting individuals to seek regular cholesterol testing. Healthcare providers are responding by promoting routine screenings, which is likely to bolster demand for cholesterol tests. Furthermore, as healthcare systems in South America evolve, there is a growing emphasis on preventive care, which includes regular monitoring of cholesterol levels. This shift towards proactive health management is expected to further stimulate the cholesterol test market, as more individuals recognize the importance of maintaining healthy cholesterol levels to mitigate cardiovascular risks.

Increased Availability of Testing Facilities

The expansion of healthcare infrastructure in South America is enhancing the availability of cholesterol testing facilities, which is a key driver for the cholesterol test market. Over the past few years, there has been a concerted effort to improve healthcare access, particularly in rural and underserved areas. This includes the establishment of new clinics and partnerships with private laboratories, which have increased the number of locations where individuals can obtain cholesterol tests. Reports indicate that the number of testing facilities has grown by approximately 15% in the last five years. This increased accessibility is likely to encourage more individuals to undergo cholesterol testing, thereby driving growth in the cholesterol test market. As more people gain access to testing services, the overall awareness and management of cholesterol levels are expected to improve.