Growing Emphasis on Data Analytics

The application server market in South America is witnessing a growing emphasis on data analytics as organizations seek to harness the power of big data. Businesses are increasingly recognizing the value of data-driven decision-making, prompting investments in application servers that can efficiently process and analyze large volumes of data. Recent reports suggest that the data analytics market in the region is expected to grow by approximately 15% annually, further driving the need for advanced application server solutions. This trend indicates that companies are likely to prioritize application servers that offer robust analytics capabilities, enabling them to gain insights and improve operational performance. As a result, the application server market is poised for growth as organizations strive to leverage data for competitive advantage.

Shift Towards Hybrid Cloud Solutions

The application server market is experiencing a shift towards hybrid cloud solutions in South America, as businesses seek to balance the benefits of both on-premises and cloud environments. This trend is driven by the need for flexibility, scalability, and cost-effectiveness in IT operations. Organizations are increasingly adopting hybrid models to optimize their application deployment strategies, allowing them to leverage existing infrastructure while integrating cloud services. Recent data indicates that the hybrid cloud market in the region is projected to grow by over 20% in the coming years. This shift is likely to create new opportunities for the application server market, as companies require solutions that can seamlessly operate across diverse environments, ensuring business continuity and enhanced performance.

Increased Mobile Application Development

The proliferation of mobile devices in South America is significantly impacting the application server market. With a growing number of consumers relying on mobile applications for various services, businesses are compelled to invest in robust application servers that can support high traffic and ensure seamless user experiences. Recent statistics indicate that mobile app usage in the region has increased by over 30% in the past year alone. This trend necessitates the deployment of scalable and efficient application servers capable of handling the demands of mobile applications. Consequently, the application server market is likely to expand as organizations prioritize mobile-first strategies, leading to enhanced performance and reliability in their digital offerings.

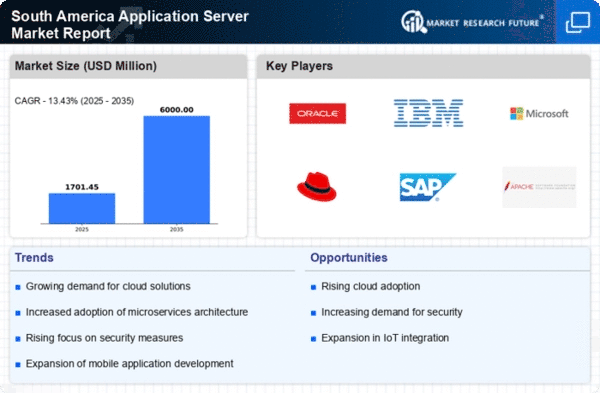

Rising Demand for Digital Transformation

The application server market in South America is experiencing a notable surge in demand driven by the ongoing digital transformation initiatives across various sectors. Organizations are increasingly adopting application servers to enhance operational efficiency and improve customer engagement. According to recent data, the market is projected to grow at a CAGR of approximately 12% over the next five years. This growth is largely attributed to the need for businesses to modernize their IT infrastructure and leverage cloud-based solutions. As companies transition to digital platforms, the application server market is likely to witness a significant uptick in investments, particularly in sectors such as finance, retail, and healthcare, where digital services are becoming essential for competitive advantage.

Government Initiatives for IT Infrastructure Development

Government initiatives aimed at enhancing IT infrastructure in South America are playing a crucial role in shaping the application server market. Various countries in the region are investing heavily in technology to foster economic growth and improve public services. For instance, initiatives to promote smart cities and e-governance are driving the demand for application servers that can support complex applications and data management. As governments allocate substantial budgets for technology upgrades, the application server market is expected to benefit from increased public sector spending. This trend may lead to a more robust IT ecosystem, ultimately enhancing the capabilities of application servers to meet the evolving needs of both public and private sectors.