Increasing Livestock Population

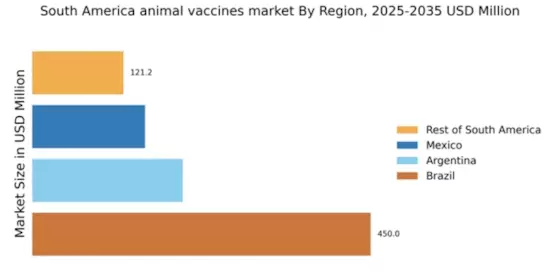

The growth in livestock population across South America is a pivotal driver for the animal vaccines market. As the demand for meat, dairy, and other animal products rises, farmers are increasingly investing in vaccination programs to ensure the health and productivity of their herds. For instance, the livestock population in Brazil alone has seen a notable increase, with estimates suggesting a rise of approximately 3% annually. This trend necessitates a robust vaccination strategy to prevent disease outbreaks, which can significantly impact production. Consequently, the animal vaccines market is likely to experience heightened demand as producers seek to safeguard their investments and maintain supply chains.

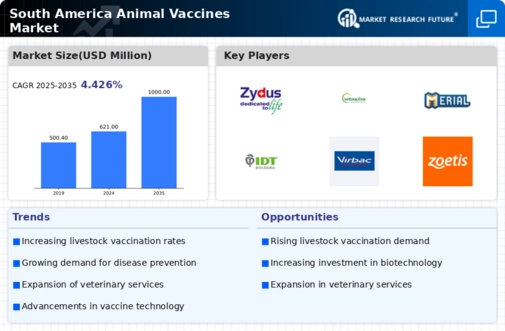

Expansion of Veterinary Services

The expansion of veterinary services in South America is significantly influencing the animal vaccines market. As veterinary practices become more accessible, farmers are increasingly turning to professional services for vaccination and health management. This trend is particularly evident in rural areas, where mobile veterinary clinics are gaining popularity. The availability of these services is expected to enhance vaccination coverage, which is crucial for disease prevention. Moreover, the veterinary services market in South America is projected to grow at a CAGR of around 5% over the next few years, indicating a robust environment for the animal vaccines market to thrive.

Rising Awareness of Animal Health

There is a growing awareness among farmers and livestock owners regarding the importance of animal health, which serves as a crucial driver for the animal vaccines market. Educational initiatives and outreach programs have been instrumental in informing stakeholders about the benefits of vaccination. Reports indicate that regions in South America, particularly Argentina and Brazil, have seen a surge in vaccination rates, with some areas reporting increases of up to 20% in the last few years. This heightened awareness is likely to foster a more proactive approach to animal health management, thereby propelling the demand for vaccines and related products within the animal vaccines market.

Regulatory Support for Vaccination Programs

Regulatory frameworks in South America are increasingly supportive of vaccination programs, which is a key driver for the animal vaccines market. Governments are implementing policies that encourage vaccination to combat zoonotic diseases and enhance food safety. For example, Brazil has established vaccination campaigns against diseases such as foot-and-mouth disease, which have proven effective in reducing outbreaks. Such initiatives not only protect animal health but also bolster public health and food security. As regulatory support continues to strengthen, the animal vaccines market is likely to benefit from increased funding and resources dedicated to vaccination efforts.

Technological Innovations in Vaccine Development

Technological innovations in vaccine development are transforming the landscape of the animal vaccines market in South America. Advances in biotechnology and genomics are leading to the creation of more effective and targeted vaccines. For instance, the development of recombinant vaccines has shown promise in enhancing immune responses while reducing adverse effects. This is particularly relevant in regions where traditional vaccines may not be as effective due to varying strains of pathogens. The investment in research and development is expected to grow, with estimates suggesting an increase of 10% in funding for veterinary vaccine research in the coming years. Such innovations are likely to drive the animal vaccines market forward, ensuring better health outcomes for livestock.