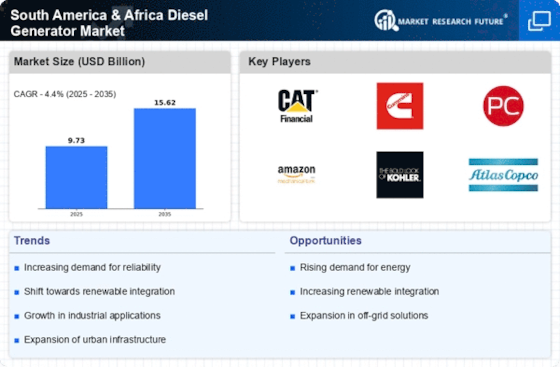

Market Share

South America & Africa Diesel Generator Market Share Analysis

Companies in the south America and Africa diesel generator market use a variety of strategies for positioning their share in this dynamic landscape to get solid footholds and gain an upper hand. It is a common practice to target product differentiation that helps the manufacturers of diesel generators create distinctive features, better performance, and more advanced technologies than other companies in order to be distinct from competitors. Through providing generators that have advanced features like better fuel consumption, less exhaust emissions and intelligent monitoring systems firms attract a refined clientele base. Geographic expansion is another critical approach, understanding the unique demands of different regions in South America and Africa. This involves designing products to the respective local needs, taking into consideration issues such as climate conditions, power utilization and regulatory requirements. Through such adjustments, companies are able to access more customers and become recognized as dependable producers of diesel generators that serve different localities. Understanding regional differences helps businesses in effectively tackling the local peculiarities, which reflect challenges and preferences arising within each market. Additionally, pricing strategies are central in market share positioning. Others choose a cost-leadership strategy, selling diesel generators at low prices to gain market share. This approach may work in price-sensitive markets, where consumers value cost. On the other hand, premium-pricing strategies position products as superior and costly to indicate their quality performance that is valued over price. Achieving that right balance between the price and value perceived by consumers is essential for companies aiming at achieving an optimum market share. This is another strategic opportunity for companies trading in the South America and Africa diesel generator market through collaboration and partnerships. It can be easier to penetrate the market and achieve a better understanding of regional trends by working with local distributors, suppliers, or governments. By establishing powerful alliances, the company is able to capitalize on already-existing networks and maneuver within regulatory settings most efficiently. Collaborations can also culminate in partnerships or co-developments which will allow companies to pool resources and know how, for purposes of dealing with individual market problems. Moreover, customer oriented approaches are considered to be priority for market share ring. Brand loyalty can be significantly increased through superior customer service, warranties, and post-sale services. Satisfied customers are more likely to be repeat clients and brand ambassadors, which eventually leads them to grow market share. In a competitive market, companies spend money on brand images by highlighting reliability and customer satisfaction as distinctive features that make their products stand out. Environmental sustainability is beginning to assume a very key role in the market share positioning for the diesel generator market. Faced with the growing knowledge of climate change and also environmental impact, companies are designing reliable generators that meet very stringent emissions regulations. This approach not only attracts the environmentally aware customers but also situates the companies ideally in the view of dynamic regulatory changes and developing global sustainability tendencies.

Leave a Comment