Market Analysis

In-depth Analysis of South America & Africa Diesel Generator Market Industry Landscape

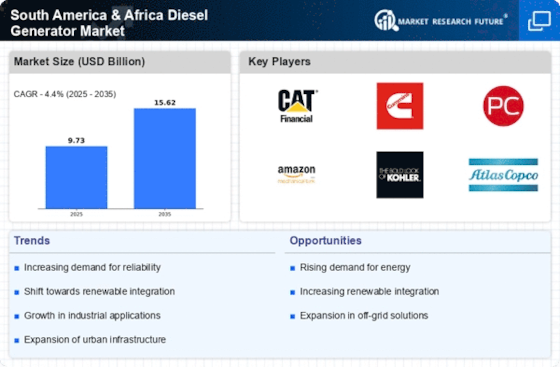

The South America & Africa Diesel Generator market is set to reach US$ 12 BN by 2032, at a 5.80% CAGR between years 2023-2032. The diesel generator market in South America and Africa is driven by a convergence of economical, social, technological elements that determines its nature. A major motivating factor is the existence of an energy infrastructure deficit in several regions resulting to high demand for reliable sources of power. In South America and Africa, there are some regions that struggle to create a steady power grid hence the diesel generators serve as an essential tool in dealing with this gap. Economics is one of the major factors behind changes in market dynamics. Economic development and industrialization that have been seen in these regions also lead to increased power use. As businesses become big and the populations continue to thrive, having constant supply of power source is critical. Diesel generators provide a reliable source of electricity, especially in areas that are far or where grid connection is difficult. Government policies and laws are also essential in influencing the market dynamics associated with diesel generators. It provides immediate energy requirements for governments to promote the use of diesel generators. But with increased concerns about the environmental problems around the world, there is a sense of need for cleaner and more environmentally friendly energy resources. This policy change may thus affect the drive towards more sustainable products. The socio-cultural factor also influences the market dynamics. Some areas depend on diesel generators for their power demands. This dependence is often caused by insufficient alternative sources of energy or lack consistent grid power. The cultural practices and the lifestyle choices additionally play a role in sustaining demand for diesel generators because they become part of everyday life in these areas. Some of the other factors that affect market dynamics in the diesel generator sector are technological developments. These generators continue to evolve due to innovations in engine efficiency, emission control and smart technologies. Manufacturers seek to produce environmentally friendly generators that are also more reliable. This technological advancement affects consumer preferences and the competitive environment in the market. Factors of competition within the industry are equally important in defining market dynamics. Both the local and international players that play in South America & Africa’s market for diesel generators create a competitive environment. Product features, performance, pricing, and after-sales services are the main issues on which companies compete. The market consolidation, strategic partnerships as well as the entry of new players are other factors that shape dynamics in this market. Market dynamics are also influenced by several external factors including geopolitical events and economic uncertainties. Investment decisions and the demand for diesel generators in these regions can be influenced by political stability. The market dynamics that follow may also be affected by changes in economic parameters such as purchasing power for businesses and household consumers.

Leave a Comment