Advancements in Medical Technology

Advancements in medical technology are driving the evolution of the 5G in Healthcare Market. Innovations such as robotic surgery, augmented reality, and artificial intelligence require high-speed connectivity to function effectively. In South America, the integration of these technologies into healthcare systems is gaining momentum, with hospitals investing in 5G infrastructure to support these advancements. For instance, the market for robotic surgery is expected to grow by over 20% annually, indicating a strong demand for the necessary connectivity that 5G provides. This trend suggests that as medical technology continues to advance, the reliance on 5G networks will become increasingly critical, thereby propelling the growth of the 5g in-healthcare market.

Government Initiatives and Investments

Government initiatives and investments play a crucial role in propelling the 5G in Healthcare Market. In South America, various governments are actively promoting the adoption of advanced technologies in healthcare to improve service delivery. For instance, initiatives aimed at enhancing digital infrastructure are being prioritized, with budgets allocated for the deployment of 5G networks. These investments are expected to reach billions of $ in the next few years, creating a conducive environment for the integration of 5G technology in healthcare. Furthermore, public-private partnerships are emerging, which could lead to innovative solutions and increased funding for healthcare projects. Such government support is likely to accelerate the growth of the 5g in-healthcare market, making advanced healthcare services more accessible to the population.

Increased Focus on Healthcare Accessibility

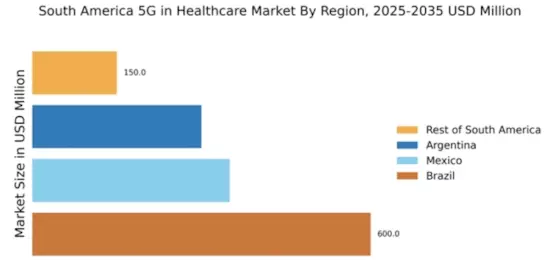

The increased focus on healthcare accessibility is a significant driver for the 5G in Healthcare Market. In South America, disparities in healthcare access have been a longstanding issue, particularly in rural areas. The implementation of 5G technology can bridge this gap by enabling telehealth services and remote consultations, thus reaching underserved populations. Reports indicate that approximately 30% of the population in rural regions lacks access to essential healthcare services. By leveraging 5G, healthcare providers can offer timely interventions and consultations, improving overall health outcomes. This emphasis on accessibility aligns with broader public health goals and is likely to stimulate demand for 5G-enabled healthcare solutions, thereby fostering growth in the 5g in-healthcare market.

Rising Demand for Remote Patient Monitoring

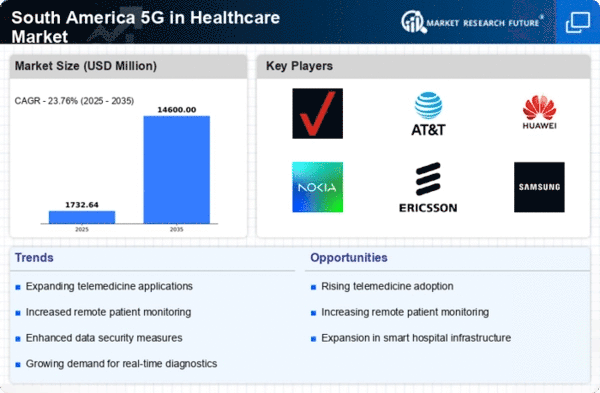

The increasing demand for remote patient monitoring is a pivotal driver in the 5G in Healthcare Market. As healthcare providers seek to enhance patient care, the ability to monitor patients remotely has become essential. In South America, the prevalence of chronic diseases necessitates continuous monitoring, which 5G technology can facilitate through high-speed data transmission. This technology allows for real-time data collection from wearable devices, enabling healthcare professionals to make informed decisions swiftly. The market for remote patient monitoring is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 25% in the coming years. This growth indicates a robust opportunity for the 5g in-healthcare market to expand its offerings and improve patient outcomes.

Growing Awareness of Data Security and Privacy

Growing awareness of data security and privacy concerns is emerging as a vital driver in the 5G in Healthcare Market. With the increasing digitization of healthcare services in South America, patients and providers alike are becoming more conscious of the need to protect sensitive health information. The implementation of 5G technology offers enhanced security features, which can help mitigate risks associated with data breaches. As healthcare organizations prioritize compliance with regulations and standards, the demand for secure, high-speed networks is likely to rise. This focus on data security not only fosters trust among patients but also encourages healthcare providers to adopt 5G solutions, thereby contributing to the expansion of the 5g in-healthcare market.