North America : Market Leader in SD-WAN

North America continues to lead the software defined wide area network (SD-WAN) market, holding a significant share of 6.0 in 2025. The region's growth is driven by increasing demand for cloud-based services, enhanced network security, and the need for efficient bandwidth management. Regulatory support for digital transformation initiatives further catalyzes market expansion, making it a hotbed for innovation in networking technologies.

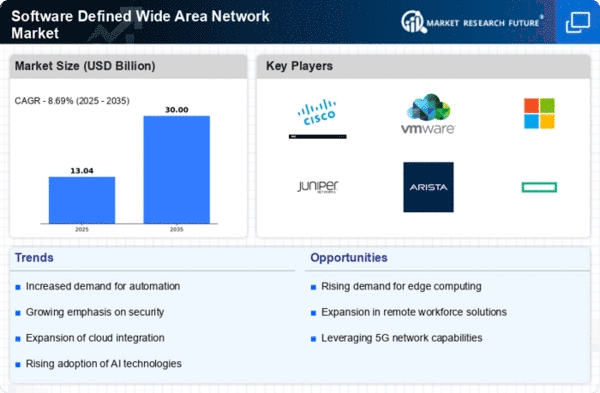

The competitive landscape is robust, with key players like Cisco Systems, VMware, and Microsoft dominating the market. The U.S. is the primary contributor, benefiting from a mature IT infrastructure and a high adoption rate of SD-WAN solutions. Companies are increasingly investing in advanced technologies to enhance service delivery and customer experience, solidifying North America's position as a leader in the SD-WAN space.

Europe : Emerging Market with Growth Potential

Europe is witnessing a rapid expansion in the software defined wide area network (SD-WAN) market, with a market size of 3.0 in 2025. The growth is fueled by the increasing need for flexible and scalable network solutions, driven by the rise of remote work and digital transformation initiatives. Regulatory frameworks promoting cybersecurity and data protection are also significant catalysts for market growth, ensuring compliance and fostering trust among users.

Leading countries in this region include Germany, the UK, and France, where major players like Nokia and VMware are making substantial investments. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share. The European market is expected to continue its upward trajectory as organizations increasingly adopt SD-WAN solutions to enhance operational efficiency and reduce costs.

Asia-Pacific : Rapid Growth in Connectivity Solutions

The Asia-Pacific region is experiencing a notable surge in the software defined wide area network (SD-WAN) market, with a market size of 2.5 in 2025. This growth is driven by the increasing adoption of cloud services, the rise of IoT, and the demand for improved network performance. Governments in the region are also promoting digital initiatives, which serve as a catalyst for the adoption of advanced networking solutions, including SD-WAN.

Countries like China, India, and Australia are leading the charge, with significant investments from key players such as Microsoft and Cisco. The competitive landscape is evolving, with both The software defined wide area network market share. As businesses in the region seek to enhance their digital capabilities, the SD-WAN market is poised for continued growth, driven by innovation and technological advancements.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa (MEA) region is gradually emerging in the software defined wide area network (SD-WAN) market, with a market size of 0.5 in 2025. The growth is primarily driven by increasing internet penetration, the rise of mobile connectivity, and the need for efficient network management solutions. Regulatory bodies are beginning to recognize the importance of digital infrastructure, which is expected to further stimulate market growth in the coming years.

Countries like South Africa and the UAE are at the forefront of this growth, with local and international players exploring opportunities in the SD-WAN space. The competitive landscape is still developing, with several startups and established firms vying for market presence. As organizations in the MEA region increasingly adopt digital solutions, the SD-WAN market is set to expand, driven by the need for enhanced connectivity and operational efficiency.

Leave a Comment