Market Share

Sodium Sulfur Battery Market Share Analysis

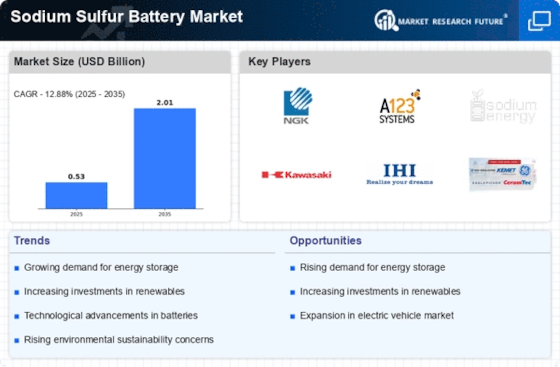

The major driving factors for sodium sulfur battery market include increasing investments in renewable energy and reduction in cost as a result of technological advancements and expanded deployment. The distribution form of power generation is becoming popular among at Southeast Asian countries since the governments have been trying to improve the electrification rates in these countries. In order to provide reliable and quick power supply to the households who are not connected to the national grid properly, electric utilities are looking forward to connecting such households with isolated grids which are standalone and engage in small scale power generation ranging from 10 kW up to 10 MW usually found in rural areas.

The primary component of every isolated grid is its energy storage device; this has ultimately made it popular among utilities as an ESS application. These drivers point towards growing prospects for the sodium sulfur battery market. The sodium-sulfur battery market is witnessing notable trends indicative of the expanding role of energy storage in the global transition towards sustainable and reliable power sources.

One key trend is that there is increasing usage of sodium-sulfur batteries in utility-scale energy storage projects. These batteries are known for their high specific capacitance value or conversely their high specific charge capacity therefore being preferred for use at grid level applications. The demand also emanates from need for large scale electrical grids stabilization while facilitating solar integration through renewable energies on one end or when there’s no enough backup power during peak load or emergencies due to blackouts.

Many sectors are increasingly employing sodium-sulfur batteries to integrate renewable energy, notably solar and wind. As wind and solar power become more prevalent in the electrical mix, effective energy storage methods are needed to compensate for their intermittent nature. Sodium-sulfur batteries are one of the best ways to store extra renewable electricity for later use when demand is high, making the grid more stable and adaptive.

Sodium-sulfur batteries are becoming used in electric buses and vehicles. Large, long-range electric vehicles like buses and lorries employ sodium-sulfur batteries due to their high energy density and cycle life. This aids worldwide efforts to electrify transport, lowering air pollution and fossil fuel use.

The market is experiencing a trend towards the modular and scalable design of sodium-sulfur battery systems. Modular configurations enable delivery of flexible ESS solutions which can be tailored according to specific project needs. Such developments account for various applications starting from small scale distributed storage systems to large utility-scale projects, thus increasing adaptability and cost effectiveness.

The significance of energy resilience and reliability are currently coming up as important considerations, especially in disaster prone areas and where the grid is unstable. This has made sodium-sulphur batteries become notable due to their ability to provide continuous power reliably during blackouts improving energy resilience. In such situations, there is need for storage systems that will ensure grid reliability as well as act as backup for emergency response team to use when there is no electricity.

Leave a Comment