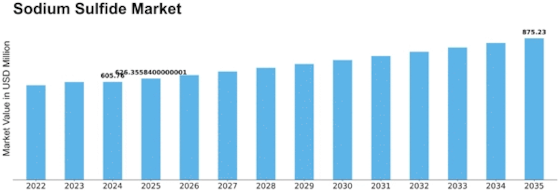

Sodium Sulfide Size

Sodium Sulfide Market Growth Projections and Opportunities

The Sodium Sulfide Market experiences influence from several factors that collectively shape its trends and growth dynamics. One primary driver is the diverse industrial applications of sodium sulfide, a chemical compound known for its versatile properties. Sodium sulfide is widely used in the leather industry for dehairing processes, in the paper and pulp industry for delignification, and in the textile industry for dyeing and printing applications. As these industries continue to evolve and expand globally, the demand for sodium sulfide remains robust, contributing to the growth of the market.

Global economic conditions play a crucial role in the Sodium Sulfide Market. Economic growth and industrialization contribute to increased demand for chemicals like sodium sulfide in manufacturing processes across various sectors. Developing economies, undergoing rapid industrial expansion and urbanization, particularly drive the market's growth as they become key players in the global manufacturing landscape.

Technological advancements in sodium sulfide production processes impact the market dynamics. Ongoing research and development efforts lead to innovations that enhance the efficiency, sustainability, and cost-effectiveness of sodium sulfide manufacturing. Companies that invest in these technological advancements gain a competitive edge by offering high-quality sodium sulfide that meets the evolving needs of various industries while minimizing environmental impact.

Environmental and regulatory considerations are critical factors in the Sodium Sulfide Market. The chemical industry faces increasing scrutiny regarding the environmental impact of its products and processes. Companies in the market must comply with stringent environmental standards, invest in sustainable production practices, and communicate their commitment to responsible chemical manufacturing to maintain a positive market position.

Geopolitical factors and trade dynamics also play a role in shaping the Sodium Sulfide Market. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can impact the supply chain and pricing of sodium sulfide. Companies need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Moreover, the mining industry significantly contributes to the demand for sodium sulfide. In mineral processing, sodium sulfide is used as a flotation agent for extracting certain minerals from ores. As the demand for metals and minerals grows globally, driven by infrastructure development and technological advancements, the use of sodium sulfide in the mining industry continues to rise.

The wastewater treatment sector is another key driver of the Sodium Sulfide Market. Sodium sulfide is employed in wastewater treatment processes for the removal of heavy metals, making it an essential chemical in environmental management. The increasing awareness of water pollution and the need for effective wastewater treatment solutions propel the demand for sodium sulfide in this sector.

Raw material prices, particularly those of sodium hydroxide and sulfur, play a role in shaping the Sodium Sulfide Market. Fluctuations in the costs of these raw materials impact the production costs and pricing of sodium sulfide. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

Sodium Sulfide Market is projected to be worth USD 672 Million by 2027, registering a CAGR of 3.4% during the forecast period (2020 - 2027).

Leave a Comment