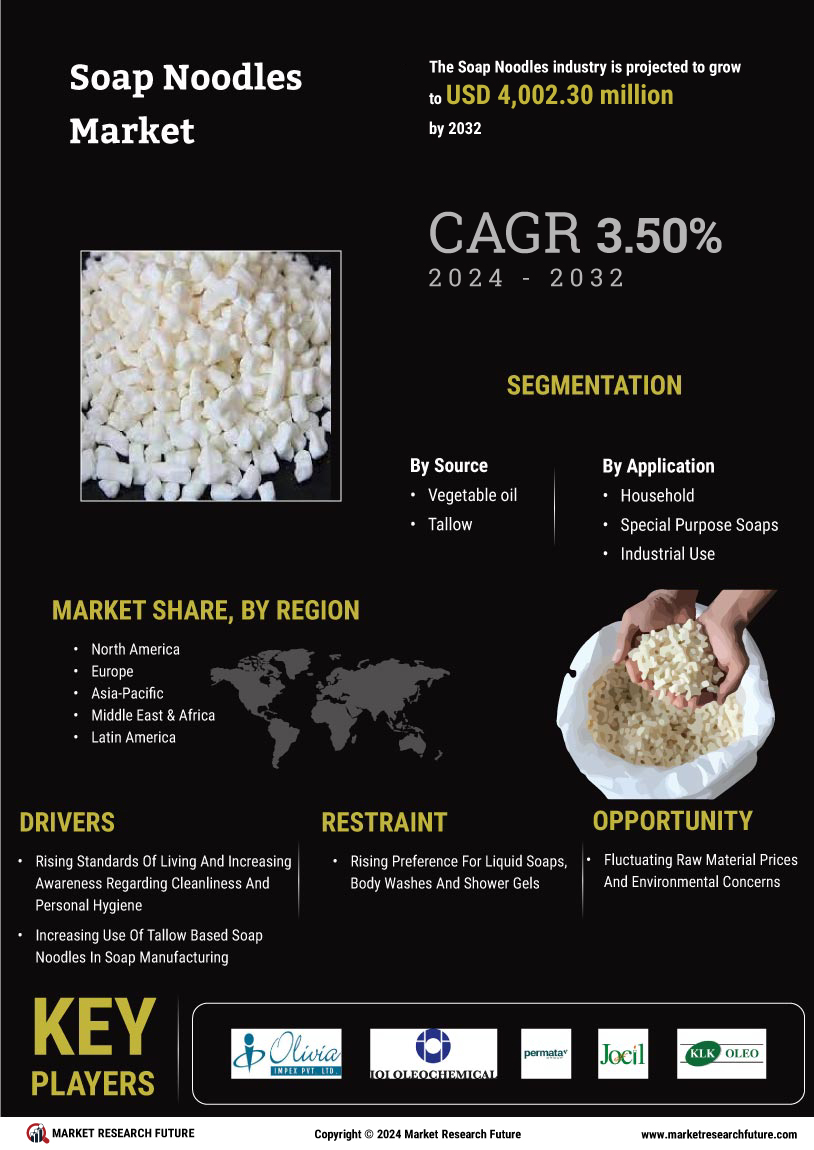

Rising Demand for Eco-Friendly Products

The Soap Noodles Market is experiencing a notable increase in demand for eco-friendly and sustainable products. Consumers are becoming more environmentally conscious, leading to a shift towards biodegradable and natural ingredients in personal care products. This trend is reflected in the growing preference for soap noodles made from plant-based oils and fats, which are perceived as safer for both users and the environment. According to recent data, the market for natural personal care products is projected to grow at a compound annual growth rate of approximately 9% over the next five years. This shift not only influences consumer purchasing decisions but also encourages manufacturers to innovate and adapt their product lines to meet these evolving preferences.

Technological Advancements in Production

Technological advancements in the production processes of the Soap Noodles Market are playing a crucial role in enhancing efficiency and product quality. Innovations such as automated manufacturing systems and improved refining techniques are enabling producers to create high-quality soap noodles with consistent properties. These advancements not only reduce production costs but also minimize waste, aligning with the industry's sustainability goals. Furthermore, the integration of digital technologies, such as data analytics and IoT, allows manufacturers to optimize their operations and respond swiftly to market demands. As a result, companies that leverage these technologies are likely to gain a competitive edge in the rapidly evolving soap noodles market.

Regulatory Support for Natural Ingredients

The Soap Noodles Market is experiencing favorable regulatory support for the use of natural ingredients in personal care products. Governments and regulatory bodies are increasingly promoting the use of safe and environmentally friendly ingredients, which aligns with the growing consumer demand for natural products. This regulatory environment encourages manufacturers to invest in the development of soap noodles derived from natural sources, thereby enhancing their market appeal. Additionally, compliance with these regulations can serve as a competitive advantage, as consumers are more likely to choose products that adhere to safety and environmental standards. As a result, the soap noodles market is poised for growth, driven by both consumer preferences and supportive regulatory frameworks.

Growing Awareness of Hygiene and Personal Care

The Soap Noodles Market is witnessing a surge in awareness regarding hygiene and personal care, particularly in emerging economies. As consumers become more informed about the importance of cleanliness and skin health, the demand for soap products, including soap noodles, is on the rise. This trend is further supported by increasing disposable incomes, which enable consumers to invest in quality personal care products. Market data indicates that the personal care segment is expected to grow significantly, with soap noodles being a key ingredient in various formulations. This heightened focus on hygiene is likely to sustain the growth of the soap noodles market in the coming years.

Expansion of the Cosmetic and Personal Care Sector

The Soap Noodles Market is benefiting from the expansion of the cosmetic and personal care sector, which is experiencing robust growth. As the demand for diverse personal care products increases, soap noodles are becoming essential ingredients in various formulations, including soaps, shampoos, and body washes. The Soap Noodles Market is projected to reach a valuation of over 500 billion dollars by 2026, with soap noodles playing a pivotal role in this growth. This expansion is driven by changing consumer preferences, with a notable shift towards multifunctional products that combine cleansing and skincare benefits. Consequently, manufacturers are increasingly incorporating soap noodles into their product lines to cater to this evolving market landscape.