Growing Focus on Data Analytics

The Smart Shopping Cart Market is increasingly influenced by the growing focus on data analytics. Retailers are recognizing the value of data collected through smart shopping carts, which can provide insights into consumer behavior and preferences. This data can be utilized to optimize inventory management, tailor marketing strategies, and enhance customer engagement. As a result, the demand for smart shopping carts that can capture and analyze data is on the rise. Market analysts suggest that the ability to leverage data analytics could lead to a potential increase in market size by approximately 15% over the next few years, as retailers aim to make data-driven decisions.

Shift Towards Omnichannel Retailing

The shift towards omnichannel retailing is significantly impacting the Smart Shopping Cart Market. Retailers are increasingly adopting strategies that integrate online and offline shopping experiences. Smart shopping carts facilitate this integration by providing features that enhance the in-store experience while complementing online shopping. For instance, customers can use smart carts to access their online shopping lists or receive notifications about in-store promotions. This trend is expected to drive market growth, with projections indicating a potential increase of 18% in market size as retailers strive to create cohesive shopping experiences across multiple channels.

Technological Advancements in Retail

Technological advancements play a pivotal role in shaping the Smart Shopping Cart Market. Innovations such as RFID technology, sensors, and mobile applications are transforming traditional shopping carts into smart devices. These advancements enable features like automatic checkout and product recommendations based on customer preferences. As retailers adopt these technologies, they enhance operational efficiency and improve customer satisfaction. The integration of such technologies is expected to contribute to a market growth rate of around 25% in the coming years, as retailers seek to leverage technology to streamline operations and enhance the shopping experience.

Increased Investment in Retail Technology

Increased investment in retail technology is a key driver of the Smart Shopping Cart Market. Retailers are allocating significant resources to adopt innovative technologies that enhance operational efficiency and improve customer experiences. The rise of e-commerce and changing consumer preferences have prompted retailers to invest in smart shopping carts that offer advanced features such as contactless payment and personalized recommendations. This trend is likely to result in a market growth rate of approximately 22% over the next few years, as retailers seek to stay competitive in an evolving retail landscape.

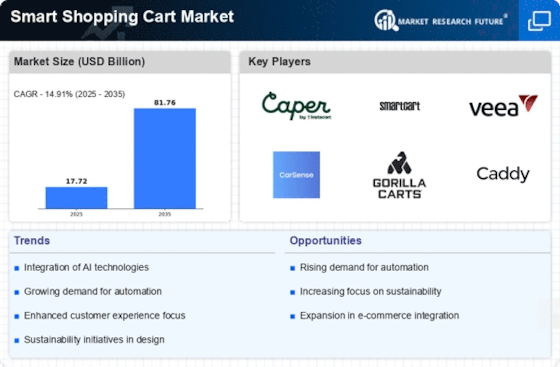

Rising Demand for Enhanced Shopping Experiences

The Smart Shopping Cart Market is witnessing a notable increase in demand for enhanced shopping experiences. Retailers are increasingly recognizing the importance of providing customers with seamless and efficient shopping solutions. Smart shopping carts, equipped with advanced technology, offer features such as real-time inventory tracking and personalized promotions. According to recent data, the market for smart shopping carts is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is driven by consumers' expectations for convenience and efficiency during their shopping trips, prompting retailers to invest in innovative solutions that cater to these needs.