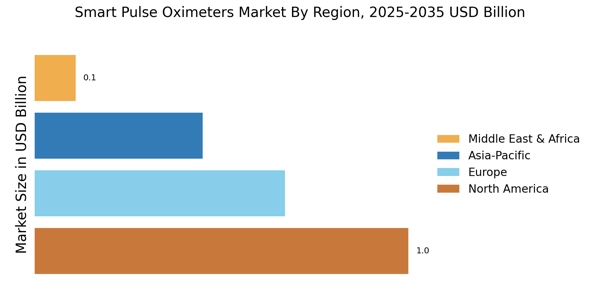

North America : Healthcare Innovation Leader

North America is the largest market for smart pulse oximeters, holding approximately 45% of the global market share. The region's growth is driven by advanced healthcare infrastructure, increasing prevalence of respiratory diseases, and a rising focus on remote patient monitoring. Regulatory support from agencies like the FDA further catalyzes innovation and adoption of smart medical devices, enhancing patient outcomes and operational efficiency. The United States leads the market, followed by Canada, with key players such as Medtronic, Masimo, and GE Healthcare dominating the landscape. The competitive environment is characterized by continuous technological advancements and strategic partnerships among manufacturers. The presence of established healthcare systems and a growing demand for home healthcare solutions are also pivotal in shaping the market dynamics.

Europe : Emerging Market with Growth Potential

Europe is witnessing significant growth in the smart pulse oximeters market, accounting for about 30% of the global share. The increasing aging population, coupled with a rise in chronic diseases, drives demand for advanced monitoring solutions. Regulatory frameworks, such as the EU Medical Device Regulation, are enhancing product safety and efficacy, thereby boosting consumer confidence and market penetration. Leading countries in this region include Germany, France, and the UK, where companies like Philips and Nihon Kohden are making substantial contributions. The competitive landscape is marked by innovation and collaboration among key players, focusing on integrating smart technology into healthcare systems. The emphasis on telehealth and remote monitoring solutions is further propelling market growth, making Europe a vital player in the global landscape.

Asia-Pacific : Rapidly Growing Healthcare Sector

Asia-Pacific is rapidly emerging as a significant market for smart pulse oximeters, holding around 20% of the global market share. The region's growth is fueled by increasing healthcare expenditure, rising awareness of health monitoring, and a growing population with chronic diseases. Government initiatives aimed at improving healthcare infrastructure and access to medical devices are also key drivers of market expansion. Countries like Japan, China, and India are at the forefront of this growth, with a competitive landscape featuring both local and international players. Companies such as Nihon Kohden and Nonin Medical are expanding their presence, focusing on innovative solutions tailored to regional needs. The increasing adoption of telemedicine and home healthcare solutions is further enhancing the market's potential in this dynamic region.

Middle East and Africa : Untapped Market with Potential

The Middle East and Africa region is gradually emerging in the smart pulse oximeters market, currently holding about 5% of the global share. The growth is driven by increasing healthcare investments, rising awareness of chronic diseases, and a push towards modernizing healthcare infrastructure. Governments are implementing policies to enhance healthcare access, which is expected to boost the adoption of advanced medical devices in the coming years. Leading countries in this region include South Africa, UAE, and Saudi Arabia, where the presence of key players like Honeywell and Zebra Medical Technologies is notable. The competitive landscape is evolving, with a focus on partnerships and collaborations to enhance product offerings. The region's unique challenges, such as varying healthcare standards, present both opportunities and hurdles for market players aiming to establish a foothold in this developing market.

.webp