Market Trends

Key Emerging Trends in the Smart Home Appliances Market

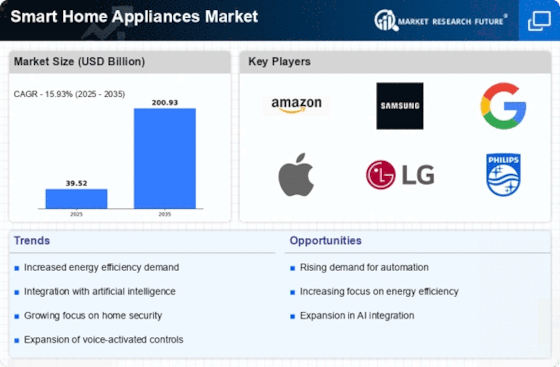

Multiple dynamic trends are growing in the market for smart home products, which shows how customers' needs and wants are changing. The rise of voice-activated tech is one of these trends. Virtual assistants like Amazon's Alexa and Google Assistant are now fundamental parts of smart homes. Many people like voice-activated tools since they are simple to use and don't need to be held in the hands. Some other big trends in the market for smart home goods are compatibility and working together. People want their electronics to be able to quickly connect to each other so that their homes can work together as a network. These factors make smart home devices more and more compatible with different systems, which leads to a smooth and natural experience. One noticeable development that affects the characteristics of the smart home device business is the introduction of cutting-edge technology like artificial intelligence (AI) and machine learning. Appliances may become more efficient and meet customer demands by gradually changing to their preferences thanks to these technologies. Artificial Intelligence (AI) augments the intelligence of smart equipment by suggesting energy-saving choices and changing thermostat settings based on daily routines. This trend suggests a change in the smart home market toward more personalized and flexible technology solutions. The rise of smart home protection features is another notable trend. More secure steps need to be taken as smart home systems get bigger. More and more homes have smart doorbells, cameras, and security systems that work with doorbells. They let people protect and keep an eye on their homes from away. The market is moving toward smart security options because they are safe and easy to use. Cheaper smart home goods are making this technology more accessible to more people. Because of more competition and better ways to make things, the prices of smart products are slowly going down. This trend is leading to more usage, which means that smart home technology is becoming a fact for more and more homes.

Leave a Comment