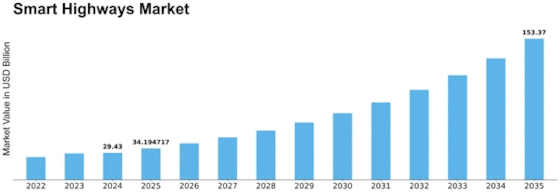

Smart Highways Size

Smart Highways Market Growth Projections and Opportunities

The Smart Highways Market is a rapidly growing industry that aims to revolutionize the way we travel and commute. With the increasing demand for safer and more efficient transportation systems, companies operating in this market are constantly seeking innovative strategies to gain a competitive edge and capture a larger market share.

One of the key market share positioning strategies employed by companies in the Smart Highways Market is product differentiation. By offering unique and technologically advanced solutions, companies can distinguish themselves from their competitors and attract a larger customer base. This can be achieved through the development of cutting-edge technologies such as smart traffic management systems, intelligent lighting solutions, and advanced communication networks. By providing these innovative solutions, companies can position themselves as leaders in the market and gain a significant market share.

Another effective strategy used by companies in the Smart Highways Market is strategic partnerships and collaborations. By forming alliances with other industry players, companies can leverage their combined strengths and resources to capture a larger market share. These partnerships can be with technology providers, infrastructure developers, or government bodies. By working together, companies can pool their expertise and resources to develop comprehensive and integrated solutions that address the needs of the market. This collaborative approach not only helps in expanding market reach but also enhances the credibility and reputation of the companies involved.

Furthermore, companies operating in the Smart Highways Market often focus on customer-centric strategies to gain a competitive advantage. By understanding the needs and preferences of their target customers, companies can tailor their products and services to meet these requirements effectively. This can be achieved through extensive market research, customer surveys, and feedback mechanisms. By incorporating customer feedback into product development, companies can ensure that their offerings align with customer expectations, thereby increasing customer satisfaction and loyalty. This customer-centric approach can help companies differentiate themselves from their competitors and capture a larger market share.

Additionally, companies in the Smart Highways Market also employ pricing strategies to gain a competitive edge and increase their market share. These strategies include offering competitive pricing, discounts, and flexible payment options to attract customers. By providing cost-effective solutions without compromising on quality and performance, companies can position themselves as the preferred choice in the market. Furthermore, companies may also offer bundled packages or value-added services to entice customers and increase their market share.

Leave a Comment