Smart Gas Meter Market Summary

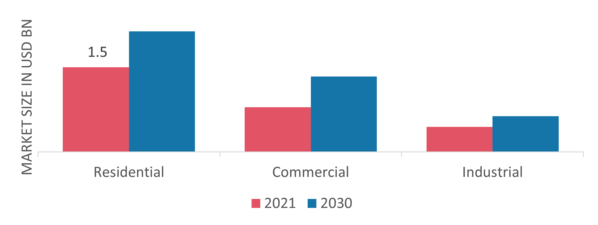

As per Market Research Future Analysis, the Global Smart Gas Meters Market was valued at USD 1.73 billion in 2024 and is projected to grow to USD 2.50 billion by 2035, with a CAGR of 3.40% from 2025 to 2035. The market is driven by the need for efficient energy usage, increased investment in smart grid projects, and rising safety regulations. The Demand For Advanced Metering Infrastructure Is Also A Significant Factor Contributing To market growth. The residential sector is expected to dominate the market, supported by government incentives and a shift towards gas consumption for domestic purposes. Major players are focusing on R&D and strategic initiatives to enhance their market presence.

Key Market Trends & Highlights

Key trends driving the Smart Gas Meters Market include technological advancements and regulatory support.

- Smart Gas Meters Market Size in 2024: USD 1.73 billion

- Projected Market Size by 2035: USD 2.50 billion

- CAGR from 2025 to 2035: 3.40%

- Residential sector projected to be the fastest-growing segment during 2022-2030

Market Size & Forecast

| 2024 Market Size | USD 1.73 billion |

| 2035 Market Size | USD 2.50 billion |

| CAGR (2024-2035) | 3.40% |

Major Players

Siemens AG (Germany), Schneider Electric (France), Landis+Gyr (Switzerland), Aclara Technologies LLC (U.S.), Xylem Inc. (U.S.), Badger Meter Inc. (U.S.), Itron Inc. (U.S.), Honeywell International Inc. (U.S.)