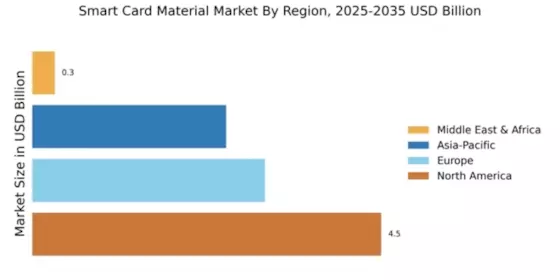

North America : Market Leader in Smart Cards

North America continues to lead the Smart Card Material Market, holding a significant share of 4.5 in 2024. The region's growth is driven by increasing demand for secure payment solutions, advancements in technology, and supportive regulatory frameworks. The rise in contactless payment systems and digital identity verification is further propelling market expansion. Additionally, government initiatives promoting digital transformation are acting as catalysts for growth.

The competitive landscape in North America is robust, featuring key players such as Gemalto, Identiv, and NXP Semiconductors. The U.S. stands out as a major contributor, with a strong focus on innovation and technology development. Companies are investing heavily in R&D to enhance product offerings and meet the evolving needs of consumers. This dynamic environment positions North America as a pivotal region in The Smart Card Material.

Europe : Emerging Market with Growth Potential

Europe is witnessing a notable transformation in the Smart Card Material Market, with a market size of 3.0 in 2024. The region's growth is fueled by increasing adoption of smart cards in various sectors, including banking, healthcare, and transportation. Regulatory initiatives aimed at enhancing security and privacy are also driving demand. The European Union's focus on digital identity and secure transactions is a significant catalyst for market growth.

Leading countries in Europe include Germany, France, and the Netherlands, where key players like Infineon Technologies and Giesecke+Devrient are making substantial contributions. The competitive landscape is characterized by innovation and collaboration among industry stakeholders. As Europe continues to embrace digital solutions, the smart card materials market is expected to expand significantly, supported by a strong regulatory framework. "The European Commission emphasizes the importance of secure digital identities for all citizens."

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is emerging as a significant player in the Smart Card Material Market, with a market size of 2.5 in 2024. The growth is driven by rising urbanization, increasing disposable incomes, and a growing demand for secure payment solutions. Countries like China and India are leading the charge, with government initiatives promoting digital payments and smart card adoption. The region's regulatory environment is becoming increasingly supportive of technological advancements.

China and India are at the forefront of this growth, with major investments in smart card technology. Key players such as NXP Semiconductors and Mitsubishi Electric are actively expanding their presence in the region. The competitive landscape is marked by rapid innovation and a focus on meeting the diverse needs of consumers. As the region continues to develop, the smart card materials market is poised for substantial growth, driven by both demand and regulatory support.

Middle East and Africa : Emerging Market with Untapped Potential

The Middle East and Africa (MEA) region is gradually emerging in the Smart Card Material Market, with a market size of 0.29 in 2024. The growth is primarily driven by increasing investments in digital infrastructure and a rising demand for secure identification solutions. Governments in the region are focusing on enhancing security measures, which is expected to boost the adoption of smart cards across various sectors, including banking and telecommunications.

Countries like South Africa and the UAE are leading the way in smart card adoption, with key players such as HID Global and CardLogix making significant inroads. The competitive landscape is evolving, with a growing number of local and international companies entering the market. As the region continues to invest in technology and infrastructure, the smart card materials market is expected to experience gradual growth, presenting numerous opportunities for stakeholders.