Market Trends

Key Emerging Trends in the Smart Biosensors Market

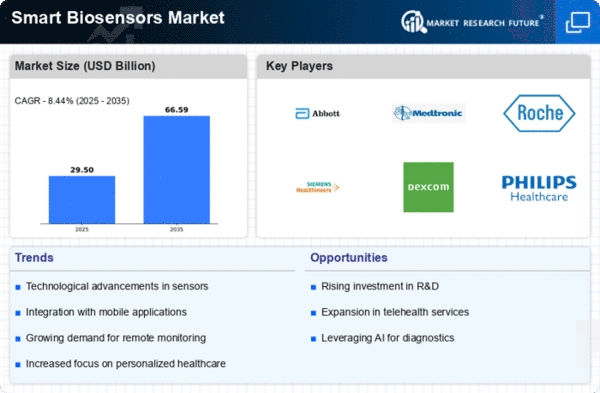

The Smart Biosensors market has seen critical development lately, determined by progressions in medical care innovation and the rising interest for constant health checking. These sensors assume an essential part in different applications, including clinical diagnostics, environmental checking, and food handling. The rising familiarity with security and health among shoppers is a critical driver for the Smart Biosensors market. These sensors offer people the capacity to screen their health boundaries continuously, working with proactive medical care management and preventive measures. The pattern towards point of care testing is driving the reception of smart biosensors in medical services settings. The capacity to get fast and on location symptomatic outcomes is significant for powerful quiet consideration, prompting expanded arrangement of biosensors in emergency clinics, centers, and home medical care. The connection of smart biosensors into wearable gadgets is picking up speed. Wearable biosensors offer clients the comfort of persistent comfort observing, giving important information to health following, constant illness management, and early identification of medical problems. The market is seeing a broadening of utilizations past medical services. Smart Biosensors are presently used in ecological observing for recognizing poisons, in the food business for quality control, and in modern cycles for guaranteeing security and effectiveness. There is a striking pattern towards scaling down and versatility in Smart Biosensors. The advancement of minimal and convenient biosensing gadgets considers simple joining into different stages, adding to their far-reaching reception across enterprises. The Smart Biosensors market is growing all around the world, with expanding reception in arising economies. The interest for smart and available medical services arrangements in these areas is driving the development of biosensor applications in assorted areas. The eventual fate of the Smart Biosensors market looks encouraging, with continuous innovative work exercises focusing in on further developing sensor capacities and investigating new applications. As innovation keeps on propelling, smart biosensors are supposed to assume an undeniably crucial part in molding the eventual fate of medical services and then some.

Leave a Comment