Smart Bed Size

Smart Bed Market Growth Projections and Opportunities

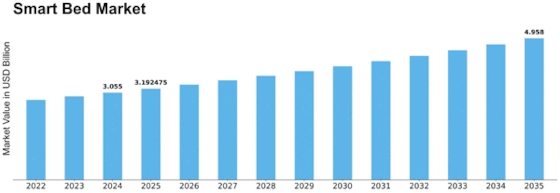

In 2022, the smart bed market was estimated to be worth USD 2.8 billion. The market for smart beds is expected to expand at a compound annual growth rate (CAGR) of 4.50% between 2023 and 2032, from an estimated USD 2.92 billion in 2023 to USD 4.16 billion by 2032. The primary factors driving market expansion are the growing emphasis on sleep quality and health, as well as the developments in sensor technology and IoT integration.

The smart bed market is influenced by various market factors that reflect the changing landscape of technology and consumer preferences in the sleep industry. Technological advancements are a primary driver in this market. The integration of smart features such as sleep tracking, adjustable firmness, and temperature control has gained popularity among consumers seeking personalized and data-driven solutions for improved sleep quality. As individuals become more health-conscious, the demand for smart beds that offer insights into sleep patterns and contribute to overall well-being is on the rise.

Consumer lifestyle changes and preferences play a crucial role in shaping the smart bed market. With an increasing emphasis on wellness and a holistic approach to health, consumers are looking for products that enhance their sleep experience. Features like adjustable positions, massage capabilities, and connectivity with other smart home devices contribute to the overall appeal of smart beds, catering to the preferences of a diverse consumer base.

Economic factors also impact the smart bed market. The affordability of smart bed technology and the willingness of consumers to invest in high-tech sleep solutions are influenced by economic conditions. During periods of economic growth, consumers may be more inclined to spend on premium smart beds with advanced features, while economic downturns may lead to a preference for more budget-friendly options.

The competitive landscape and innovation are critical factors in the smart bed market. Companies strive to differentiate themselves by introducing cutting-edge technologies and unique features. The constant innovation in materials, sensors, and connectivity options contributes to the rapid evolution of smart beds, with manufacturers competing to offer the most advanced and user-friendly products.

Health and wellness trends also drive the smart bed market. As awareness of the importance of sleep for overall health increases, consumers are actively seeking solutions that address specific sleep-related issues. Smart beds with features like anti-snore technology, adjustable lumbar support, and sleep environment optimization cater to the growing demand for products that contribute to better sleep health.

Environmental considerations are becoming increasingly important in the smart bed market. Consumers are showing a preference for sustainable and eco-friendly products. Manufacturers that prioritize the use of environmentally friendly materials, energy-efficient technologies, and sustainable production practices are gaining favor among environmentally conscious consumers.

Retail trends and distribution channels are additional market factors shaping the smart bed industry. The rise of e-commerce has made smart beds more accessible to consumers, providing a convenient way to browse, compare, and purchase products online. Traditional brick-and-mortar retailers continue to play a role, particularly for consumers who prefer to test the comfort and features of a smart bed in person before making a purchase.

Regulatory standards and certifications also impact the smart bed market. Compliance with safety and quality standards ensures that smart beds meet the necessary requirements for consumer health and well-being. Certifications related to materials, electronics, and overall product safety contribute to consumer trust and confidence in the smart bed market.

Leave a Comment