Market Growth Projections

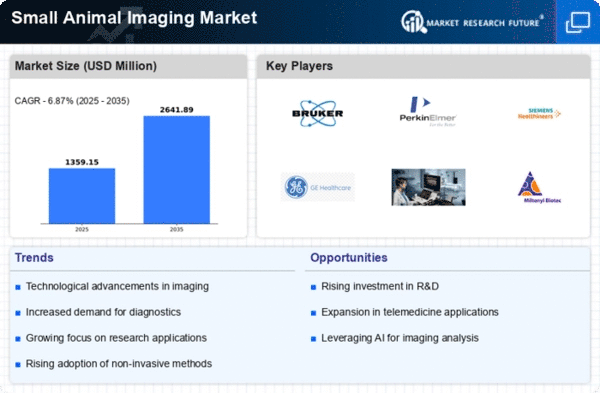

The Global Small Animal Imaging Market Industry is projected to experience significant growth over the coming years. With a market value of 1.27 USD Billion in 2024, it is anticipated to reach 2.64 USD Billion by 2035, reflecting a robust CAGR of 6.88% from 2025 to 2035. This growth trajectory indicates a strong demand for advanced imaging technologies and methodologies in preclinical research. The increasing recognition of the importance of small animal models in understanding human diseases and testing new therapies is likely to drive this upward trend.

Regulatory Support for Animal Research

The Global Small Animal Imaging Market Industry is supported by regulatory frameworks that promote the use of animal models in research. Regulatory bodies are increasingly recognizing the value of small animal imaging in the development of new therapies and drugs. This support is likely to enhance the credibility of research findings, encouraging more institutions to invest in imaging technologies. As regulations evolve to facilitate ethical research practices, the market is expected to benefit from increased adoption of small animal imaging techniques, further solidifying its role in biomedical research.

Rising Demand for Preclinical Research

The Global Small Animal Imaging Market Industry is significantly influenced by the increasing demand for preclinical research in drug development and disease modeling. Researchers are increasingly utilizing small animal models to study human diseases, which necessitates advanced imaging techniques for accurate data collection. This trend is expected to contribute to the market's expansion, with projections indicating a growth to 2.64 USD Billion by 2035. The ability to visualize the effects of new therapies in real-time enhances the research process, making small animal imaging an essential component of modern biomedical research.

Growing Investments in Biomedical Research

The Global Small Animal Imaging Market Industry benefits from the growing investments in biomedical research. Governments and private entities are allocating substantial funds to support research initiatives that utilize small animal models for studying complex diseases. This influx of funding is likely to drive the adoption of advanced imaging technologies, as researchers seek to enhance their capabilities. With a projected CAGR of 6.88% from 2025 to 2035, the market is poised for sustained growth, reflecting the increasing recognition of the importance of small animal imaging in advancing medical science.

Technological Advancements in Imaging Modalities

The Global Small Animal Imaging Market Industry is experiencing rapid growth due to continuous technological advancements in imaging modalities. Innovations such as high-resolution MRI, PET, and CT imaging are enhancing the precision and accuracy of small animal studies. These advancements facilitate better visualization of biological processes, which is crucial for preclinical research. In 2024, the market is projected to reach 1.27 USD Billion, driven by the demand for sophisticated imaging techniques that improve research outcomes. As these technologies evolve, they are likely to attract more investments, further propelling market growth.

Increase in Chronic Diseases and Aging Population

The Global Small Animal Imaging Market Industry is also propelled by the rising incidence of chronic diseases and the aging population. As the prevalence of conditions such as cancer, cardiovascular diseases, and neurological disorders increases, there is a heightened need for effective research methodologies. Small animal imaging plays a crucial role in understanding disease mechanisms and testing new treatments. This growing focus on chronic disease research is expected to contribute to the market's growth, aligning with the broader trends in healthcare and research priorities.