Growing Pet Insurance Adoption

The increasing adoption of pet insurance in the US is contributing to the growth of the small animal-imaging market. As more pet owners secure insurance coverage, they are more likely to seek advanced diagnostic services, including imaging. This trend is reflected in the pet insurance market, which has seen a growth rate of approximately 15% annually over the past few years. With insurance coverage, pet owners are more inclined to pursue necessary imaging procedures, thereby driving demand within the small animal-imaging market. This shift not only benefits pet owners but also encourages veterinary practices to enhance their imaging capabilities.

Increased Focus on Animal Welfare

There is a growing emphasis on animal welfare within the veterinary community, which is positively impacting the small animal-imaging market. As veterinarians and pet owners prioritize the health and well-being of animals, the demand for comprehensive diagnostic tools is likely to increase. This focus on welfare is reflected in the rising number of veterinary schools and training programs in the US, which are incorporating advanced imaging techniques into their curricula. The small animal-imaging market stands to benefit from this trend, as more practitioners become skilled in utilizing imaging technologies to ensure better health outcomes for pets.

Rising Demand for Veterinary Services

The small animal-imaging market is experiencing a notable increase in demand for veterinary services, driven by a growing awareness of pet health and wellness. As pet owners become more informed about the benefits of advanced imaging techniques, such as MRI and CT scans, the need for these services is likely to rise. In the US, the veterinary services market was valued at approximately $30 billion in 2023, with imaging services representing a significant segment. This trend suggests that as more pet owners seek specialized care, the small animal-imaging market will expand, providing opportunities for veterinary practices to invest in advanced imaging technologies.

Regulatory Support for Veterinary Imaging

Regulatory support for veterinary imaging practices is emerging as a significant driver for the small animal-imaging market. The US government has been actively promoting the use of advanced imaging technologies in veterinary medicine through various initiatives and funding programs. This support not only encourages the adoption of new technologies but also ensures that veterinary practices comply with safety and quality standards. As regulations evolve to accommodate advancements in imaging, the small animal-imaging market is likely to see increased investment and innovation, ultimately enhancing the quality of care provided to small animals.

Integration of Advanced Imaging Technologies

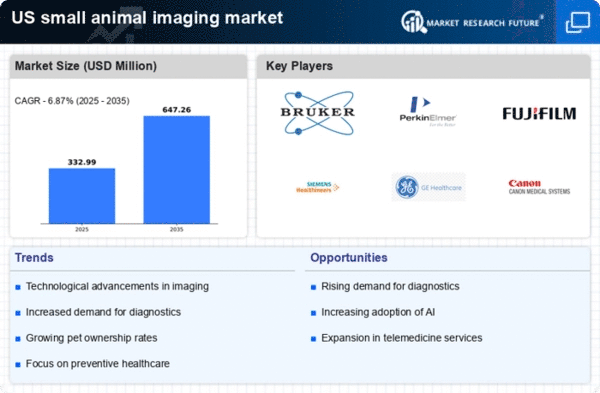

The integration of advanced imaging technologies into veterinary practices is a key driver for the small animal-imaging market. Innovations such as digital radiography and ultrasound are becoming increasingly accessible to veterinary clinics, enhancing diagnostic capabilities. The market for veterinary imaging equipment is projected to grow at a CAGR of around 8% from 2023 to 2028, indicating a robust demand for these technologies. This growth is likely to be fueled by the need for accurate and timely diagnoses, which are essential for effective treatment plans in small animals. Consequently, the small animal-imaging market is poised for significant advancements as technology continues to evolve.