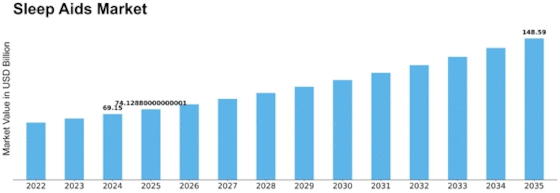

Sleep Aids Size

Sleep Aids Market Growth Projections and Opportunities

The sleep aids market is anticipated to reach USD 112.6 billion by 2032 at 7.2% CAGR. Several variables define the Sleep Aids industry. The rising frequency of sleep problems and awareness of the value of adequate sleep for health and well-being are major causes. Modern lives, stress, and environmental factors disrupt sleep, increasing need for effective sleep aids. Due to the dangers and negative effects of sleep drugs, strict regulations and approval processes assure their safety, effectiveness, and proper usage. Pharmaceutical businesses must follow regulatory requirements to convince healthcare experts and customers that new sleep aids are safe and reliable.

Economic factors influence the Sleep Aids market. Sleep aid usage varies by demography due to the economic cost of untreated sleep problems, including healthcare expenditures, lower productivity, and mental and physical health effects. Economic factors, healthcare expenditure habits, and insurance coverage affect market growth and whether people can buy sleep aids.

Sleep Aids market influence comes from consumer knowledge and education. Education regarding sleep hygiene, the risks of untreated sleep problems, and treatment alternatives raises awareness and demand for sleep aids. Pharmaceutical businesses and healthcare professionals promote sleep-related awareness initiatives to educate the public.

Technology in sleep monitoring and therapy affects the Sleep Aids business. Wearable gadgets, sleep monitoring applications, and home-based sleep testing aid sleep problem diagnosis. Advanced non-pharmacological therapies including cognitive-behavioral therapy for insomnia (CBT-I) and sleep hygiene programs provide alternatives to medicine. These technology advances improve sleep management and provide people more alternatives to suit their requirements.

Changing mental health awareness and the link between mental health and sleep impact the Sleep Aids industry. Research on sleep and mental health expands the market and explores novel therapies that treat both."

Leave a Comment