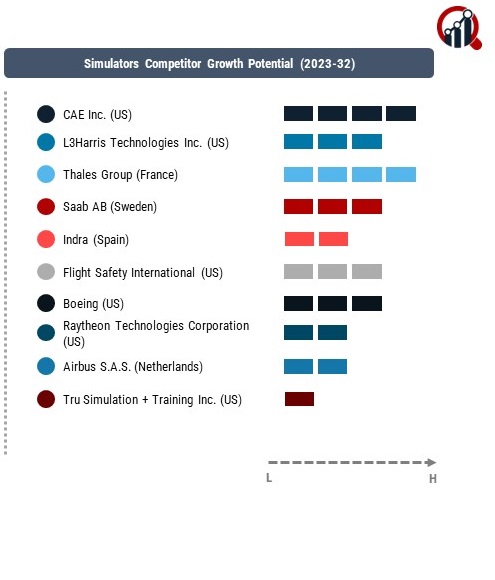

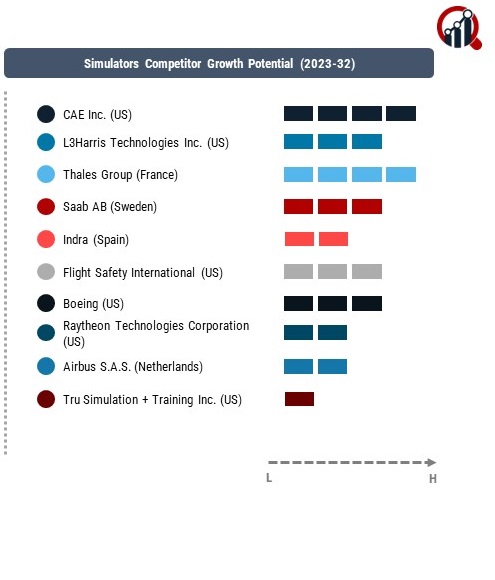

Top Industry Leaders in the Simulators Market

Strategies Adopted:

Technological Innovation: Key players focus on developing advanced simulators equipped with state-of-the-art visual systems, motion platforms, and immersive environments to provide realistic training experiences for pilots, driving market adoption and differentiation.

Diversified Product Portfolio: Offering a comprehensive range of simulator solutions for various aircraft types, including fixed-wing, rotary-wing, and unmanned systems, allows companies to cater to diverse customer needs and expand market presence.

Strategic Partnerships: Collaboration with aircraft manufacturers, airlines, defense agencies, and training centers enables companies to co-develop customized simulator solutions, secure contracts, and enhance customer relationships, driving market penetration.

Global Expansion: Establishing regional offices, training centers, and partnerships worldwide enables companies to access new markets, leverage local expertise, and capitalize on emerging opportunities in regions with growing demand for simulator training solutions.

Key Companies in the simulators market include

CAE Inc. (US)

L3Harris Technologies Inc. (US)

Thales Group (France)

Saab AB (Sweden)

Indra (Spain)

Flight Safety International (US)

Boeing (US)

Raytheon Technologies Corporation (US)

Airbus S.A.S. (Netherlands)

Tru Simulation + Training Inc. (US)

Factors for Market Share Analysis:

Simulation Fidelity: Market share analysis considers the fidelity and realism of simulators, including visual quality, motion dynamics, and flight modeling accuracy, with companies offering high-fidelity solutions commanding a larger market share.

Training Capabilities: The breadth and depth of training capabilities, including initial pilot training, recurrent training, mission rehearsal, and emergency procedures, influence market share by addressing diverse training requirements and customer preferences.

Customer Base: Market share is influenced by the size and loyalty of the customer base, including commercial airlines, military organizations, flight training academies, and simulation service providers, reflecting market penetration and customer satisfaction levels.

After-Sales Support: Effective after-sales support, including maintenance services, software updates, technical assistance, and training programs, enhances customer loyalty, fosters long-term relationships, and contributes to market share growth.

Industry News:

Simulation Technology Advancements: Industry news highlights advancements in simulation technology, including augmented reality (AR), virtual reality (VR), and artificial intelligence (AI), enhancing training realism, efficiency, and effectiveness across various domains.

Regulatory Compliance: Companies invest in regulatory compliance initiatives, such as meeting FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) standards, to ensure simulator certification, operational safety, and regulatory compliance.

Hybrid Training Solutions: Integration of simulation with live training exercises, debriefing tools, and scenario-based training enables companies to offer comprehensive and cost-effective training solutions, addressing evolving customer needs and training requirements.

COVID-19 Impact: The COVID-19 pandemic has accelerated the adoption of remote and virtual training solutions, driving demand for distributed simulation networks, cloud-based training platforms, and remote instructor-led training programs.

Current Company Investment Trends:

Digital Transformation: Investments in digital transformation initiatives, including cloud computing, data analytics, and predictive maintenance, enable companies to optimize simulator performance, enhance training efficiency, and provide personalized learning experiences.

Virtual Training Solutions: Companies invest in virtual training solutions, including e-learning modules, web-based training platforms, and mobile applications, to offer flexible and scalable training options, catering to remote and distributed workforce requirements.

Sustainability Initiatives: Increasing focus on sustainability initiatives, such as energy-efficient simulator designs, eco-friendly materials, and carbon offset programs, aligns with corporate social responsibility goals and enhances brand reputation and customer appeal.

Strategic Acquisitions: Strategic acquisitions and partnerships enable companies to expand product portfolios, acquire new technologies, and enter adjacent markets, driving growth, and market consolidation in the simulator industry.

Simulators Industry Developments

February 2022:

Kongsberg Digital (KDI) has received a significant tender. It will provide South Metropolitan TAFE (Technical and Further Education) institute in Fremantle, Western Australia, with a wide range of marine simulator systems.

March 2022:

Bohemia Interactive Simulations was fully acquired by BAE Systems for USD 200 million, according to an announcement. The business specializes in creating realistic training simulations for the armed forces. Bohemia Interactive Simulations collaborates with 300 integrators that support 60 different militaries all around the world.