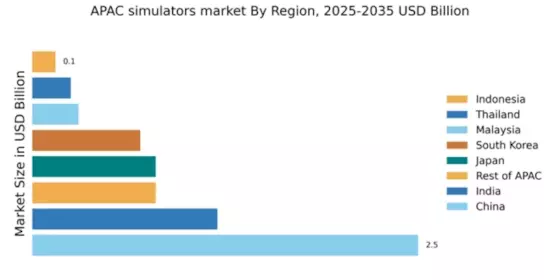

China : Unmatched Growth and Innovation

China holds a commanding 2.5% market share in the APAC simulator market, driven by rapid technological advancements and increased defense spending. The government's focus on modernizing military capabilities and enhancing training programs has spurred demand for advanced simulators. Regulatory support, such as the 14th Five-Year Plan, emphasizes innovation in defense technologies, while significant investments in infrastructure bolster industrial development.

India : Strong Demand and Local Innovation

Key markets include Bengaluru, Hyderabad, and Delhi, where major players like HAL and L3Harris Technologies are establishing a strong presence. The competitive landscape is evolving, with local firms collaborating with international players to enhance capabilities. The aviation and defense sectors are the primary consumers of simulators, fostering a dynamic business environment.

Japan : Focus on Quality and Precision

Tokyo and Yokohama are key markets, hosting major players like CAE Inc. and Thales Group. The competitive landscape is marked by a blend of domestic and international firms, fostering innovation. The defense and aerospace sectors are primary consumers, with a growing interest in virtual reality applications enhancing training methodologies.

South Korea : Defense Modernization and Innovation

Seoul and Busan are pivotal markets, with significant presence from companies like Lockheed Martin and Northrop Grumman. The competitive landscape is dynamic, with local firms partnering with international giants to enhance capabilities. The defense sector is the primary consumer, with a growing emphasis on integrating AI and VR technologies into training programs.

Malaysia : Investment in Defense and Training

Kuala Lumpur and Putrajaya are key markets, with players like Boeing and Thales Group establishing a presence. The competitive landscape is evolving, with local firms emerging alongside established international players. The defense and aviation sectors are primary consumers, with a focus on enhancing training methodologies through advanced simulation technologies.

Thailand : Focus on Defense and Aviation Training

Bangkok and Chiang Mai are key markets, with significant presence from companies like Raytheon Technologies and CAE Inc. The competitive landscape features a mix of local and international players, fostering innovation. The defense and aviation sectors are primary consumers, with a growing emphasis on integrating advanced technologies into training programs.

Indonesia : Focus on Defense and Aviation Growth

Jakarta and Surabaya are key markets, with emerging players collaborating with international firms to enhance capabilities. The competitive landscape is evolving, with local firms gaining traction. The defense and aviation sectors are primary consumers, with a growing interest in advanced training methodologies and technologies.

Rest of APAC : Varied Market Dynamics Across Regions

Key markets include Singapore and Vietnam, where players like General Dynamics and L3Harris Technologies are establishing a presence. The competitive landscape is characterized by a mix of local and international firms, fostering innovation. The defense and aviation sectors are primary consumers, with a growing emphasis on integrating advanced technologies into training programs.