Market Growth Projections

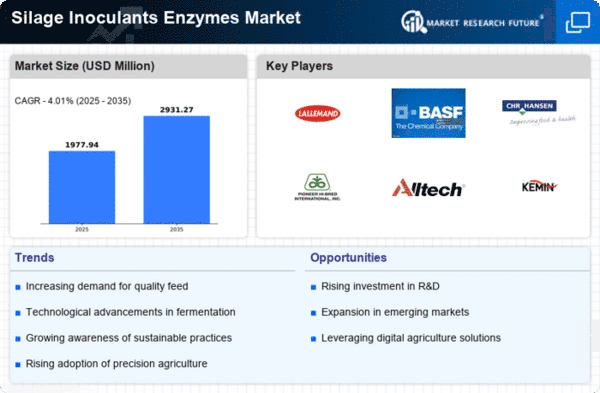

The Global Silage Inoculants and Enzymes Market Industry is projected to experience substantial growth over the next decade. With a market value of 1.9 USD Billion in 2024, it is anticipated to reach 2.93 USD Billion by 2035, reflecting a compound annual growth rate of 4.03% from 2025 to 2035. This growth is driven by various factors, including technological advancements, increasing awareness of sustainable practices, and government support for livestock feed quality. The market's expansion indicates a robust future for silage inoculants and enzymes as essential components in modern agriculture.

Rising Demand for High-Quality Forage

The Global Silage Inoculants and Enzymes Market Industry is experiencing a surge in demand for high-quality forage due to the increasing livestock population and the need for efficient feed management. As farmers seek to enhance the nutritional value of silage, the use of inoculants and enzymes becomes more prevalent. In 2024, the market is projected to reach 1.9 USD Billion, driven by the necessity for improved feed quality. This trend is likely to continue as livestock producers aim to maximize productivity and profitability, indicating a robust growth trajectory for the industry.

Global Population Growth and Food Demand

The Global Silage Inoculants and Enzymes Market Industry is significantly impacted by global population growth and the corresponding increase in food demand. As the world population continues to rise, the pressure on livestock producers to provide high-quality meat and dairy products intensifies. This demand drives the adoption of silage inoculants and enzymes, which are essential for improving feed efficiency and livestock productivity. The market's growth trajectory is expected to align with these demographic trends, further solidifying its importance in meeting future food requirements.

Technological Advancements in Silage Preservation

Technological innovations in silage preservation techniques are significantly influencing the Global Silage Inoculants and Enzymes Market Industry. New formulations and application methods enhance the effectiveness of inoculants and enzymes, leading to better fermentation processes and improved silage quality. These advancements not only optimize the preservation of nutrients but also reduce spoilage, which is crucial for maintaining feed quality. As a result, the market is expected to grow, with projections indicating a rise to 2.93 USD Billion by 2035, reflecting the industry's adaptation to modern agricultural practices.

Government Support and Subsidies for Livestock Feed

Government initiatives and subsidies aimed at improving livestock feed quality are playing a pivotal role in the Global Silage Inoculants and Enzymes Market Industry. Many governments are implementing policies that encourage the use of advanced silage preservation methods, including the application of inoculants and enzymes. This support not only enhances the economic viability of livestock production but also promotes food security. As a result, the market is poised for growth, with increasing investments in agricultural technology and practices that foster better feed management.

Increasing Awareness of Sustainable Farming Practices

The Global Silage Inoculants and Enzymes Market Industry is benefiting from a growing awareness of sustainable farming practices among agricultural producers. Farmers are increasingly recognizing the environmental and economic advantages of using inoculants and enzymes to enhance silage quality and reduce waste. This shift towards sustainability is likely to drive market growth, as producers seek solutions that align with eco-friendly practices. The anticipated compound annual growth rate of 4.03% from 2025 to 2035 suggests that the industry will continue to expand as sustainability becomes a central focus in agriculture.