Rising Urbanization and Population Growth

The Side Loader Truck Market is significantly influenced by the trends of rising urbanization and population growth. As more individuals migrate to urban areas, the demand for efficient waste collection and management systems intensifies. Side loader trucks are particularly well-suited for densely populated regions, where space constraints make traditional collection methods less effective. The United Nations projects that by 2050, nearly 68% of the world’s population will reside in urban areas, which could lead to an increased need for waste management vehicles. This demographic shift suggests that the side loader truck market may see substantial growth as municipalities adapt to the challenges posed by urban living.

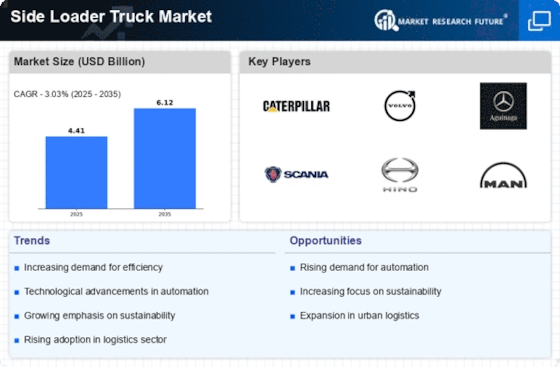

Technological Innovations in Vehicle Design

The Side Loader Truck Market is benefiting from ongoing technological innovations in vehicle design and functionality. Manufacturers are increasingly integrating advanced technologies such as telematics, automated systems, and eco-friendly engines into side loader trucks. These innovations not only enhance operational efficiency but also contribute to reduced emissions and improved safety. For instance, the incorporation of GPS tracking systems allows for optimized routing, which can lead to significant fuel savings. As the industry moves towards more sustainable practices, the demand for technologically advanced side loader trucks is expected to rise, potentially reshaping the competitive landscape of the market.

Government Initiatives for Environmental Sustainability

The Side Loader Truck Market is positively impacted by government initiatives aimed at promoting environmental sustainability. Many governments are implementing stricter regulations regarding waste management and emissions, which encourages the adoption of cleaner technologies in waste collection vehicles. Side loader trucks, known for their efficiency and lower environmental impact, are becoming a preferred choice for municipalities looking to comply with these regulations. Recent policies have incentivized the purchase of eco-friendly vehicles, which could lead to increased investments in side loader trucks. This trend suggests that the market may expand as more entities seek to align with sustainability goals.

Growing Focus on Cost-Effective Waste Collection Solutions

The Side Loader Truck Market is witnessing a growing focus on cost-effective waste collection solutions. As operational costs continue to rise, waste management companies are seeking ways to enhance efficiency while minimizing expenses. Side loader trucks offer a practical solution by reducing the need for multiple personnel during collection, thereby lowering labor costs. Additionally, their design allows for quicker collection times, which can lead to increased service capacity. Market analysis indicates that companies investing in side loader trucks may experience improved profitability due to these efficiencies. This trend highlights the potential for growth in the side loader truck market as businesses strive for cost-effective operational strategies.

Increasing Demand for Efficient Waste Management Solutions

The Side Loader Truck Market is experiencing a notable surge in demand due to the increasing need for efficient waste management solutions. Municipalities and private waste management companies are seeking advanced vehicles that can optimize collection processes. Side loader trucks, with their ability to pick up waste from the side, enhance operational efficiency and reduce labor costs. According to recent data, the waste management sector is projected to grow at a compound annual growth rate of 5.5% over the next five years, driving the need for specialized vehicles. This trend indicates that investments in side loader trucks are likely to rise, as they offer a practical solution to the challenges faced in urban waste collection.